Housing activity – starts and permits – posted strong results in September as the single-family segment made gains across most of the country while multifamily housing appears to be trending flat. Total housing starts rose to a 1.415 million annual rate from a 1.388 million pace in August, a 1.9% increase. The September gain is the fourth rise in the last five months since hitting an April low.

The dominant single-family segment, which accounts for almost 80% of new home construction, rose 8.5% for the month to a rate of 1.108 million. Starts of multifamily structures with five or more units tumbled 14.7% to 295,000. From a year ago, total starts are up 11.1% with single-family starts up 22.3% and multifamily starts down 17.4%.

Among the regions in the report, total starts rose in three of the four regions. The Northeast led the gainers with a 66.7% surge while the South, the largest region by volume, rose 6.2%, and the West gained 1.4% for the month. The Midwest fell 32.7%. For the single-family segment, the Northeast again led with a 20.7% rise while the South increased 17.7% and the West added 1.6% for the month. The Midwest had a 16.4% drop.

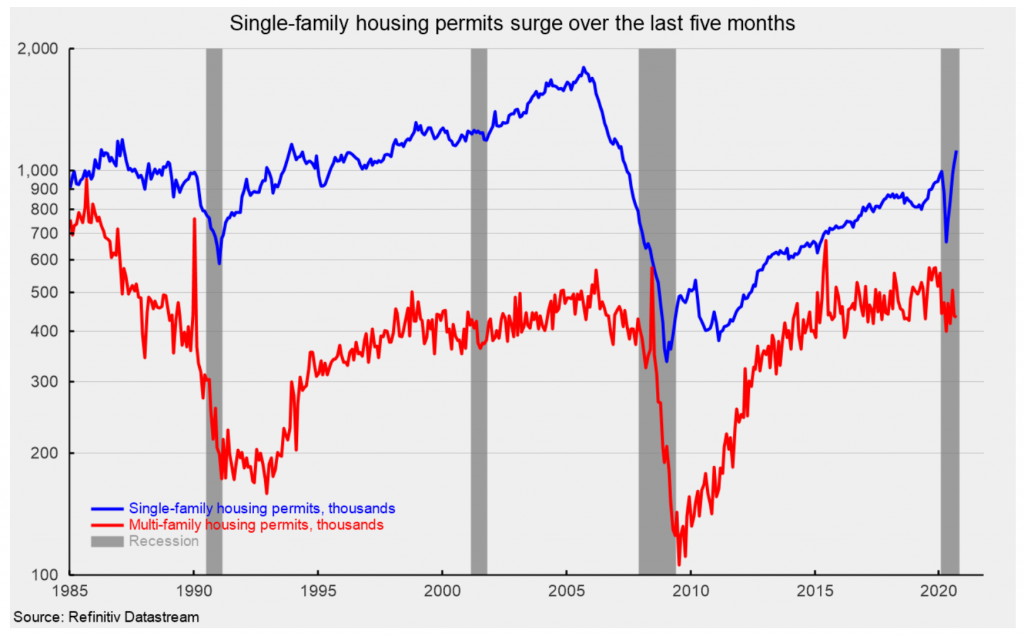

For housing permits, total permits jumped 5.2% to 1.553 million from 1.476 million in August. Total permits are 8.1% above the September 2019 level. Single-family permits were up 7.8% at 1.119 million, the highest rate since March 2007, while permits for two- to four-family units fell 15.4% and permits for five or more units increased 1.0% to 390,000. Combined multifamily permits were 434,000, down 0.9% for the month and 19.2% from a year ago. Overall, single-family permits are showing persistent strength since the April low while multifamily permits are essentially trending sideways (see first chart).

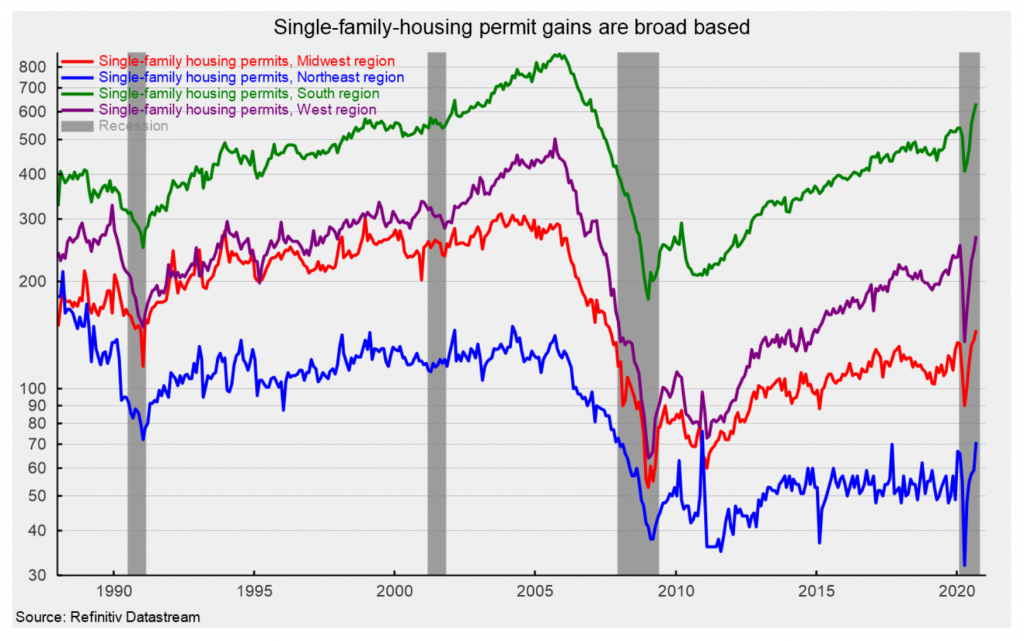

Single-family permits rose in all four regions in the report, with the South up 6.0%, the West posting a 9.8% rise, the Midwest gaining 6.6% and the Northeast jumping 20.3 (see second chart). From a year ago, the South is up 22.2%, the West is 28.1% higher, the Midwest gained 17.7% and the Northeast rose 47.9%. All four regions are at or near multi-year highs (see second chart).

Single-family home construction activity has recovered sharply since the April low as lockdown restrictions that impacted both construction workers and potential customers were eased. Mortgage rates are near all-time lows, providing support for the recovery though lending standards have tightened amid the policy-induced economic malaise.

Housing is one of the areas that may be experiencing structural change. There appears to be sustained marginal demand for less dense suburban and rural housing as urban dwellers, primarily renters, seek alternative housing. This trend could be boosted if businesses implement permanent work from home policies, to make employees happy but also to cut down on high-cost commercial real estate, especially in high-density, high-cost cities.

This article was previously published by the American Institute of Economic Research.