Overwhelming evidence points to the growth of the Southeast region

CBRE’s recent US Development Opportunities 2021 report showed that, statistically, the region has been dominant and is forecast for continued growth over the next several years, with Atlanta, Orlando, Charlotte, Raleigh-Durham and Miami being near the top of most metrics.

Reports from moving companies have illustrated the same. A recent study of moves by United Van Lines showed that seven of the top 10 states for moves in 2020 are in the Southeast region.

Although the major markets in the Southeast tend to get most of the headlines, the smaller cities are where growth is really taking off. Charlotte, Nashville, Jacksonville and Orlando are all finding rapid growth. Greenville, known for its diverse economy, is one of the nation’s fastest-growing cities. Since 2016, more than 84,000 people have relocated to Greenville-Spartanburg, 7% of the market’s total population. West Palm Beach has also gained attention, from both a booming single-family housing market to an office market that is statistically one of the hottest in the US.

“Leasing professionals have reported that rents in south Florida are increasing practically with each new lease transaction”

Industrial markets throughout the Southeast have continued to see robust demand and growth, due in large part to the surrounding port growth driven by the ongoing e-commerce expansion. The region is anchored by three major ports: Savannah, Miami and Charleston, and all three have seen growing activity. Combined they have seen an 11.3% increase in container volume over the past three years (2017-2020). Industrial property fundamentals throughout the Southeast have seen similar growth to keep up. During the first half of 2021, Atlanta ranked second in the nation, with 17 million sq ft of net absorption. Strong demand has prompted developers to build more warehouses, with over 30 million sq ft of construction activity, the largest in the country. Nashville also continues to see strong demand for industrial space given its central location, putting it within two-day ground delivery of 72% of the US population. The Southeast markets have different supply and demand dynamics. South Florida, for example, has a robust industrial market, although land constraints make it difficult to develop more industrial properties. As a result, land costs have increased considerably and rents for industrial space are rising rapidly. Leasing professionals have reported that rents in south Florida are increasing practically with each new lease transaction.

Although the retail industry has faced some challenges throughout the recession, strong population growth among the Southeast states has encouraged retailers to continue expansion plans into the region. According to Oxford Economics, from 2010 to 2020, the US population grew at a 6.6% rate. Several of the states within the Southeast saw their population grow at rates considerably elevated past the average. Florida’s population grew over 15% over that same period, with South Carolina, North Carolina and Georgia not far behind, with double-digit growth rates of their own. Forecasted population growth suggests more of the same, with the Carolinas, Florida, Georgia and Tennessee all expected to grow at a rate sharper than the US average.

This growth has kept Southeast retail occupancy at manageable levels despite major retailers cutting back on total locations. Investors have taken note. Nashville was the market with the highest year-over-year growth in retail investment sales, with Orlando and Tampa also in the top five. CBRE investment sales professionals have noted that grocery anchored, open-air centres have been quite active as of late. Single tenant, fast-food locations with drive-thrus have been heavily sought-after. This is especially true in Florida, where 2020 saw record levels of sales volume and pricing in that particular asset class..

Tech employment growth throughout the Southeast has been a driving factor for office demand and, ultimately, its economic expansion. This helped place eight Southeastern markets among the top 50 markets, according to CBRE’s 2021 Scoring Tech Talent report. Atlanta, Raleigh, Charlotte, Orlando, Tampa, South Florida, Nashville and Jacksonville all placed among the top markets in North America. The report’s tech talent score highlights the comparative advantages of 13 different metrics across 50 of the largest markets in the US and Canada. Many factors help drive tech companies to the Southeast; South Florida is the second most economical market and Nashville, Charlotte and Atlanta are all among the top five most diverse tech markets in the country when considering underrepresented race/ethnic groups.

“An unprecedented amount of new-to-market office tenants are currently seeking space across South Florida, pushing rents for Class A properties to new heights”

The shutdown of offices and stay-at-home orders have affected much of the office market in the US. It has not hurt office leasing in Miami, where office leasing professionals report an active market, with less sublease space on the market than it did pre-pandemic. An unprecedented amount of new-to-market office tenants are currently seeking space across South Florida, pushing rents for Class A properties to new heights, especially in Miami and West Palm Beach. Over the past two years, Charlotte has led markets in office rent growth.

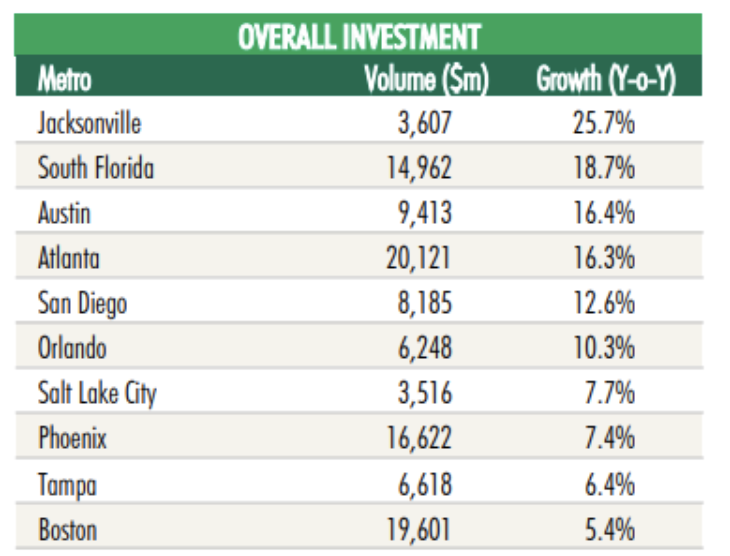

Southeastern markets had the strongest investment growth for the year ending in Q2 2021, largely due to growth in the region, as well as pandemic restrictions being less severe. Jacksonville, South Florida, Atlanta, Orlando and Tampa were all among the top10 markets for overall year-over-year investment growth. These markets combined saw over $50b in overall investment volume over the past year. Nashville showed strong gains, including the top retail investment growth, and Charlotte’s multifamily volume jumped 57%, the fifth most.

The recession caused some market volatility, especially with construction materials. Steel and lumber spiked, along with other materials used for finishing projects, such as rebar and glass. Furthermore, wage growth in the Southeast has been catching up to other areas of the country, making it less competitive on pricing to other high-wage locations. For example, Florida has instituted a plan to raise the minimum wage $1 per year until 2026, when it tops out at $15/hour.

Other challenges exist for commercial real estate in the Southeast. Rising insurance costs for coastal properties has gotten the attention of owners. Unions are also starting to take hold in the region, which will further push wages for janitorial and support staff for buildings. Although these examples will indeed affect operating costs, rising rents and stable occupancy should override the increases. In the short and long run, commercial real estate in the Southeast remains a solid investment.