A continuing upward trend makes this a good defensive asset class amid global uncertainty

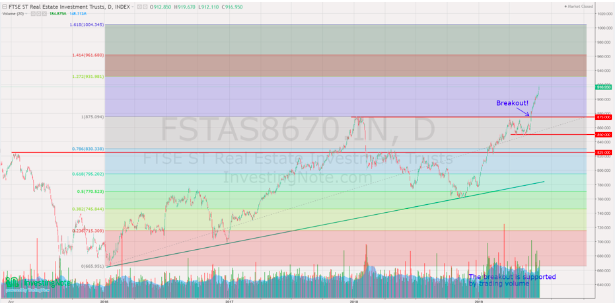

Early this summer the FTSE ST Real Estate Investment Trusts index broke through the 875 level after 10 years of resistance, with a significant increase in trading volume (see the chart in figure 1). The index increased from 858.67 to 916.95 (+6.78%) between 3 June and 1 July.

The REIT index is entering into uncharted territory after breaking a new high and may head towards 1,000 points, based on

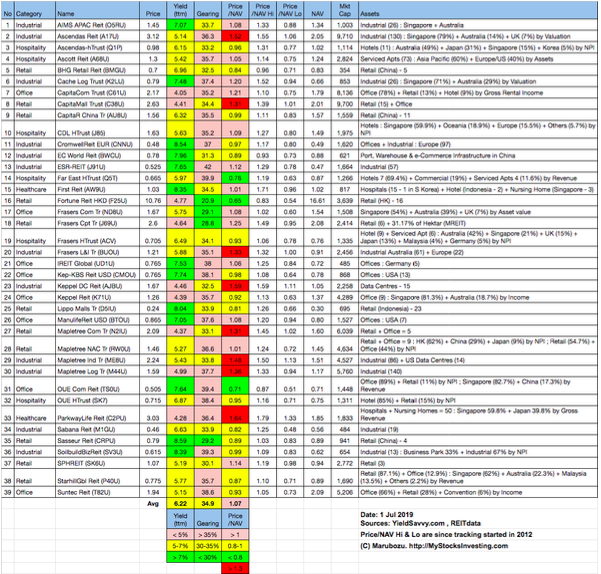

The table in figure 2 is a compilation of 39 REITs in Singapore with colour coding of the distribution yield, gearing ratio and price to NAV ratio. This gives investors at a quick glance an idea of which REITs are attractive enough to deserve in-depth analysis. The two new IPOs, ARA US Hospitality Trust and Eagle Hospitality Trust, are not included in this table because of insufficient data points.

The key points to note from this table are as follows:

- Price/NAV has increased from 1.02 to 1.07 (Singapore overall REIT sector is overvalued now).

- Distribution yield has decreased from 6.51% to 6.22% – note that this is a lagging number. About 33.3% of Singapore REITs (13 out of 39) have a distribution yield that is greater than 7%.

- Gearing ratio remains at 34.9%, with 22 out of 39 having a gearing ratio of more than 35%. In general, the Singapore REITs sector gearing ratio is healthy. Note that the limit of gearing ratio for REITs listed on the Singapore Stock Exchange is 45%.

- The most overvalued REIT is Parkway Life (price/NAV of 1.64), followed by Ascendas REIT (price/NAV of 1.52), Keppel DC REIT (price/NAV of 1.59) and Mapletree Industrial Trust (price/NAV of 1.48), Mapletree Logistic Trust (price/NAV of 1.36), Frasers Logistic & Industrial Trust (price/NAV of 1.33) and CapitaMAll Trust (price/NAV of 1.31)

- The most undervalued (based on NAV) is Fortune REIT (price/NAV of 0.65), followed by OUE Comm REIT (price/NAV of 0.71) and Far East Hospitality Trust (price/NAV of 0.78).

- The REIT with the highest distribution yield (TTM) is Sasseur REIT (8.59%), followed by First REIT (8.35%), SoilBuild BizREIT (8.39%), Cromwell European REIT (8.54%) and Lippo Mall Indonesia Retail Trust (8.04%).

- Those with the highest gearing ratios are ESR REIT (42.0%), Far East HTrust (39.9%) and OUE Comm REIT (39.4%) and SoilBuild BizREIT (39.3%).

- The top five REITs with the biggest market

capitalisation are Ascendas REIT ($9.7B), CapitaMall Trust ($9.7B), Capitaland Commercial Trust ($8.1B), Mapletree Commercial Trust ($6.0B) and Mapletree Logistic Trust ($5.7B)s - The bottom three REITs with the smallest market

capitalisations are BHG Retail REIT ($354M), Sabana REIT ($484M) andiREIT Global REIT ($485M).

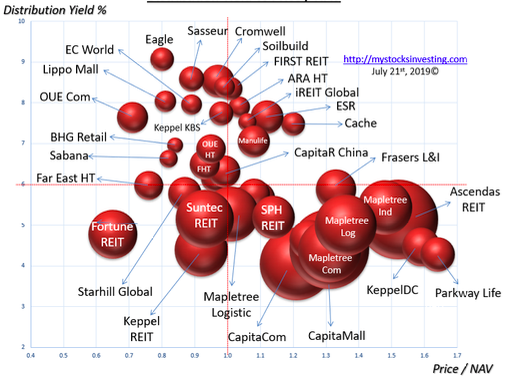

The chart in figure 3 shows the relative positioning of distribution yield versus price/NAV for each individual REIT. The current bullishness in the REIT sector is mainly powered by the REITs with bigger market

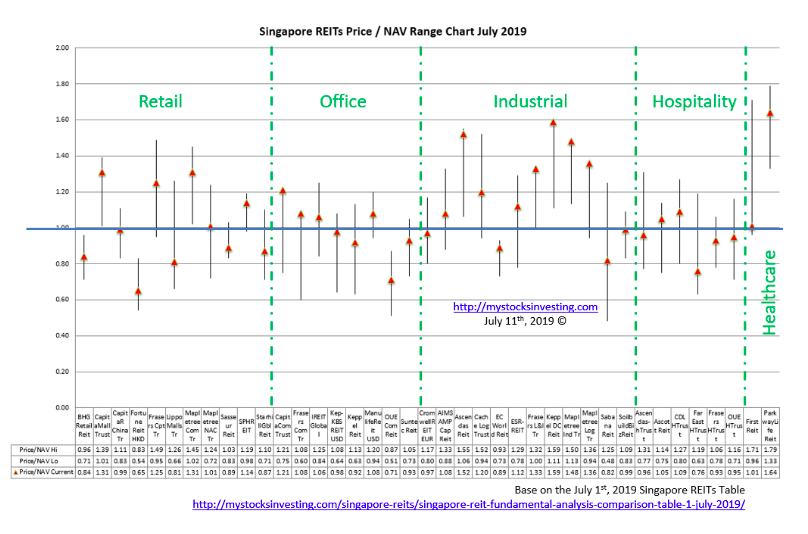

The chart in figure 4 shows the current price/NAV compared with the historical range for the past seven years. In general, the industrial sector is overvalued, as a number of industrial REITs are being traded at a historical high. There are still some REITs from the retail, office, hospitality and healthcare sectors trading at the lower range of historical price/NAV.

In terms of market outlook for the second half of 2019, fundamentally the whole Singapore REITs sector is overvaluednow, based on simple average price/NAV. The big-cap REITs are getting quite expensive and the distribution yields are currently not so attractive. Most of the distribution-per-unit (DPU) yield for big-cap REITs is below 5% now. The yield spread between big-cap and small-cap REITs remains wide. This indicates value picks only in the small and medium-cap REITs.

Yield spread (by reference to the 10-year Singapore government bond of 2.015%) has tightened from 4.448% to 4.205%. DPU yields for a number of small and mid-cap REITs are still very attractive (above 8%) at the moment. Some small and medium-sized REITs are starting to move up, due to attractive risk premium compared with big-cap REITs.

Technically, the REIT index is trading in a bullish, upward trend. This bullish sentiment may push the index up further, supported by an increasing trading volume caused by institutional fund inflows into Singapore REITs. In addition, Singapore REITs may take advantage of the low interest rate environment to take on more debt to grow the current portfolio.

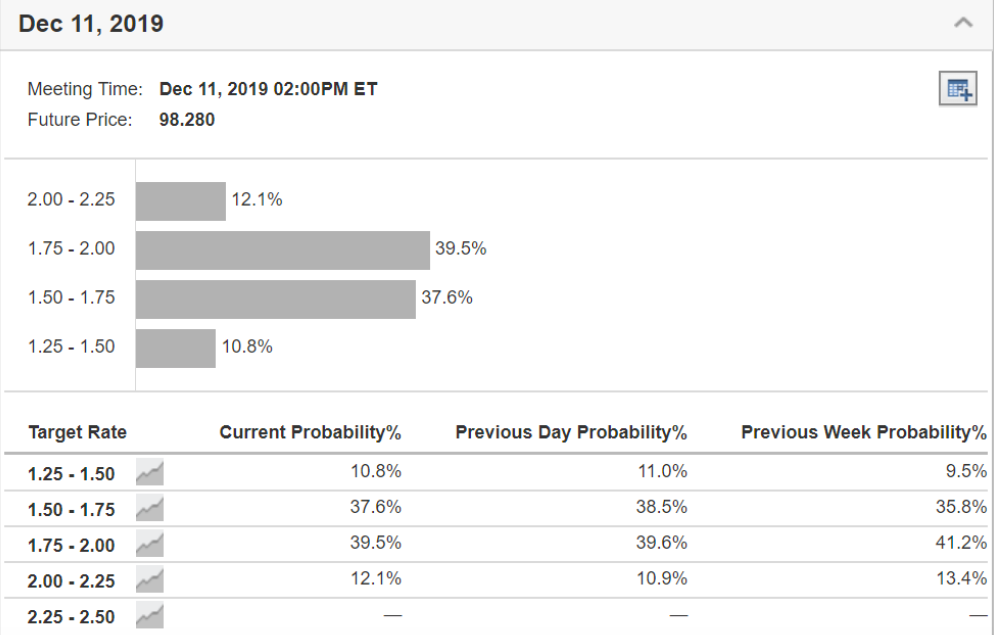

Based on the Fed Rate Monitor (shown in figure 5), the probability of keeping the interest rate at 2.25-2.50% is 0%. This means US Fed Reserve may cut the interest rate of 50bps to 1.75-2.00% by the end of this year. This provides

Recently the Monetary Authority of Singapore has released a consultation paper to seek potential options to increase gearing from 45% to the range of 50-55%, with a minimum interest rate coverage ratio. This increase of gearing limit enables Singapore REITs to have higher debt room to compete with private equity funds and/or developers which have higher gearing limits to acquire overseas assets from third parties.

In summary, the Singapore REITs sector may continue its bullish upward trend for the rest of 2019 with attractive distribution yields, as one of the defensive asset classes amid global economy uncertainties.