Although the covid pandemic has had a major impact on the Pacific Rim office markets, Real Capital Analytics reports show that considerable regional real estate investment attention has focused on the traditional office sector in recent years. Within a Pacific Rim office REIT-based portfolio, Australia has played a more prominent role than Japan, the US or Singapore, according to a new analysis published in my PhD thesis.

Key players of Pacific Rim office REITs

Strong growth of Pacific Rim office REITs has been seen in the past nine years. The size of Pacific Rim office REITs has grown from US$48.5bn in July 2006 to US$146.4bn in December 2018 – a 300% increase – according to my constructed database, with consideration of survival bias.

The most vigorous growth in market capitalisation was in the US, with a 384% increase since 2006 – up from US$22.4bn in July 2006 to US$86.3bn in December 2018, ahead of Singapore (309%; US$11.3bn in 2018), Australia (219%; US$13.2bn) and Japan (218%; US$35.5bn). As of a proportion of the market, office REITs averagely accounted for 42.0% of the size of the REIT market in Japan over the last nine years, followed by that in Singapore (15.9%), the US (13.0%) and Australia (12.2%).

Players of Pacific Rim office REITs are Boston Properties (US; US$ 17.4bn), Alexandria Real Estate Equities (US; US$12.4bn), Kilroy Realty Corporation (US; US$6.3bn), Nippon Building Fund (Japan; US$8.9bn), Japan Real Estate Investment (Japan; US$7.8bn), Japan Prime Realty (Japan; US$3.5bn), Dexus (Australia; US$7.6bn), Investa Office Fund (Australia; US$2.4bn), CapitaLand Commercial Trust (Singapore; US$4.8bn) and Keppel REIT (Singapore; US$2.8bn).

Investment performance of Pacific Rim office REITs

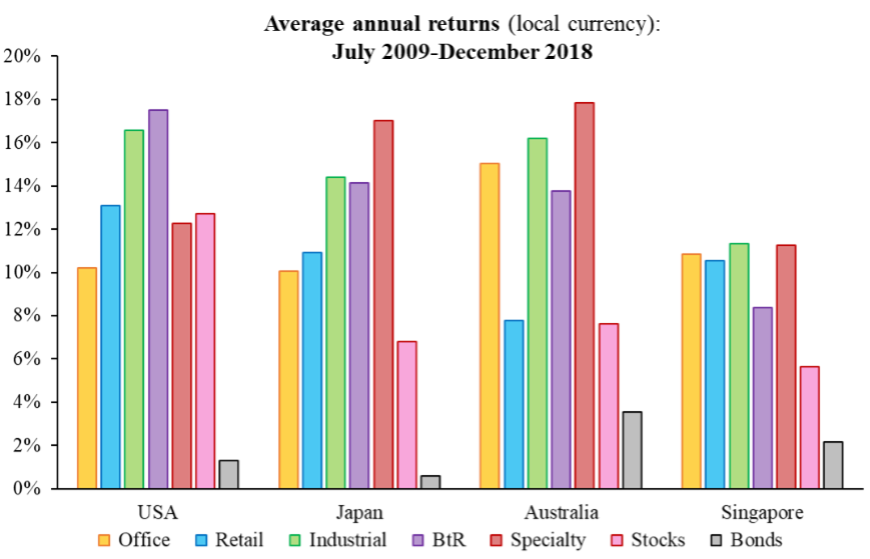

Compared with other property sectors in the Pacific Rim region, office REITs had lesser average annual returns over the past nine years. The exceptions are Australia and Singapore. On the other hand, office REITs provided stronger annual returns than both stocks and bonds in each case. However, it was the poorest performer among all property sectors in the US.

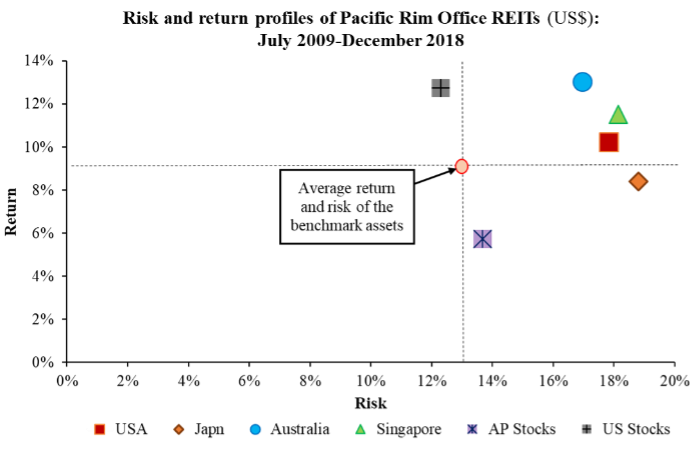

To reflect that international property investors, particularly REMFs and international real estate investors, with capital have a mandate to gain exposure to regional real estate portfolios, the Pacific Rim office REIT-based portfolio was constructed and analysed. Australia registered the highest average annual returns at 13.0%, followed by Singapore (11.5%), the US (10.2%) and Japan (8.4%). Compared with regional stocks, Pacific Rim office REITs were a more attractive high-risk investment asset for investors seeking listed investment exposure in the region.

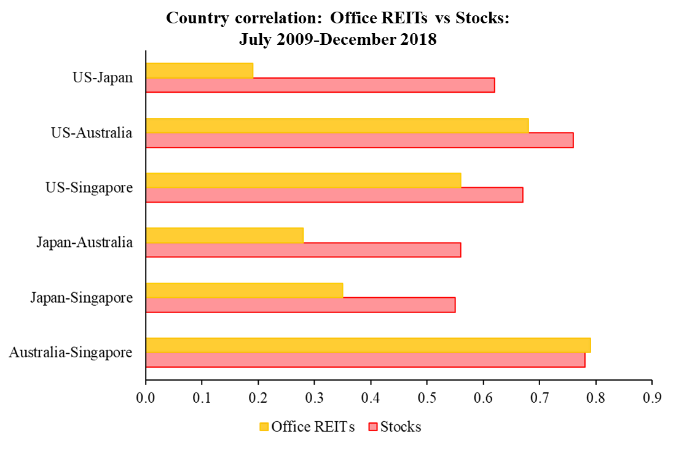

In particular Australia could post greater investment returns with a higher risk levels than US stocks. A cross-country inter-office REIT (average r=0.48) investment strategy offered 18% more geographic diversification compared with an inter-stock (average r=0.66) investment framework. The only exception is via an Australia-Singapore approach (r=0.79), which was slightly higher than an inter-stock investment framework (r=0.78) with the same investment vehicle.

In terms of a cross-country inter-office REIT investment framework, the strongest geographic diversification can be achieved by using a US-Japan diversification approach (r=0.19), followed by Japan-Australia (r=0.28), Japan-Singapore (r=0.35), US-Singapore (r=0.56), US-Australia (r=0.68) and Australia-Singapore (r=0.79) approaches.

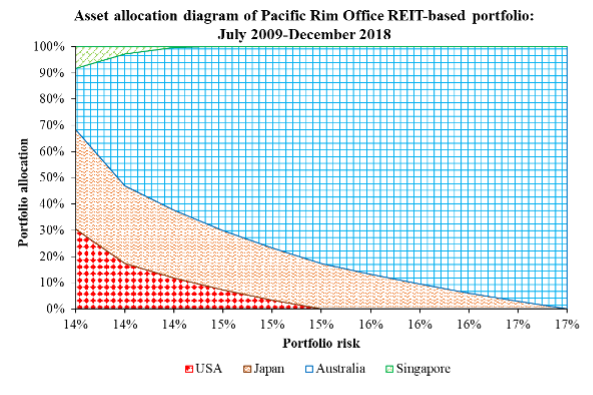

Within the regional office REIT-based portfolio, Australia played an exceptional role (an average allocation=75.7%) across the entire risk-return spectrum, due to having the highest average annual returns and the lowest risk level among the four markets in the region. Australia weakened Japan (16.8%), the US (6.4%) and Singapore (1.0%) as the risk level increased. Despite being the second-best risk-adjusted performer, Singapore was only positioned at the start of the risk-return spectrum, since it was strongly correlated with Australia.

The added-value role of Australian office REITs in the regional portfolio was further validated by the Australian highest office acquisition record year of 2019, with a market value of US$17.9bn, according to Real Capital Analytics and IPE Real Assets reports. In Australia, Blackstone purchased office towers from Scentre Group for US$1.5bn in 2019, while Link REIT acquired one of office towers from Blackstone, with a transaction volume of US$468.9m. Meanwhile, Oxford Properties bought an office tower from Stockland, with a record of US$340m. The office investment volume edged up to the second-highest level in 2018. Oxford Properties reached a US$3.2bn deal with Investa Office Fund for an office portfolio. Blackstone also included a Sydney office tower in its portfolio from Mirvac for US$647.6m.

Compared with Australia, Japan was less attractive for cross-border investors. In Japan, Daiwa Office REIT sold an office tower to GIC for US$571.9m in 2018, as well as a US$599.1m transaction between Nippon Building Fund and Mitsui Fudosan.

Briefly, Australia has been witnessed as a hotspot for office acquisitions in the region. The recent market trend has been reflected by the analysis of comparably strong investment performance and appealing geographic diversification benefits for Australia in the regional office REIT-based portfolio.

What next?

While office sector was not a strong institutional investment appetite in the Pacific Rim real estate investment markets due to its lesser investment performance than other property sectors in the region, substantial regional real estate investment attention has focused on office sector in recent years.

Although the increasing adoption of remote working is expected to weaken global office demand, the impact in the Pacific Rim region is comparably mild since the regional real estate market has attracted cross-border investor interest, according to the 2021 investor intentions survey by CBRE.

All research findings here are sourced from my PhD thesis entitled “The Risk and Return Characteristics of Sector-specific Real Estate Investment Trusts in the Asia-Pacific” (Chapter 7, section 7.2) here.