Originally published January 2021.

The European real estate universe grows ever move diverse by the year, with the constant geographical expansion of previous times now replaced by a push into new sectors and, more fundamentally, new ways of investing, with an exposure to the operational side of the asset.

This has been driven by a need among investors to find secure income sources as well as a desire to see different performance drivers and to reweight their portfolios to reflect changing business and social trends.

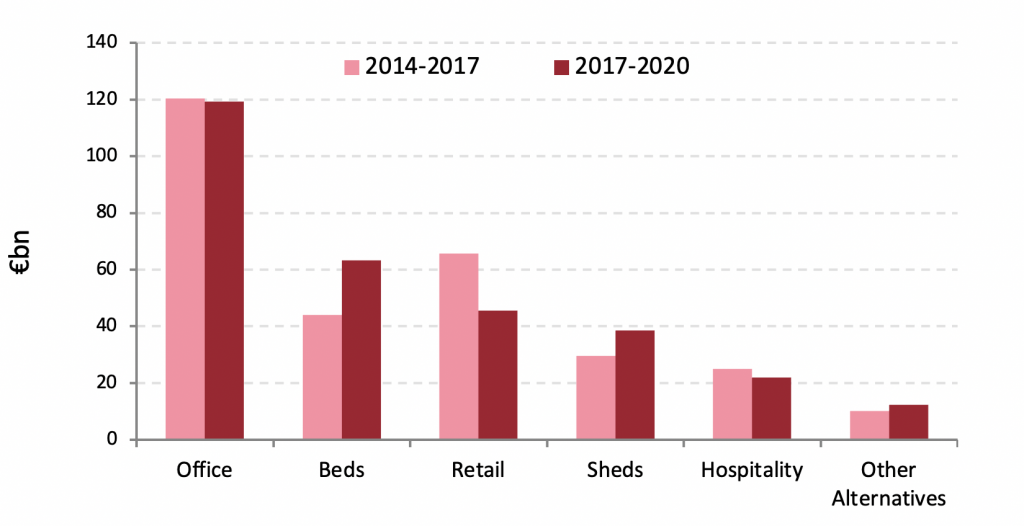

The transition has been led by both ‘beds and sheds’ but while logistics gets the headlines, ‘beds’ are now the second-largest investment sector after offices and are growing at the fastest rate, by 44% in the past three years compared with 30% for logistics and 21% for ‘other’ alternatives.

Sector changes in European investment

Beds and other alternatives together have increased their market share at the expense of retail and hospitality from 18% to 25%, and by far the largest and fastest-growing part of this has been multi-family residential, speaking for 17% of the market.

Many of the other ‘alternatives’ are of course smaller sectors with volatile trading records and often development and operationally led, meaning sector expertise is critical and, in some cases, carries specific reputational risks. Residential space, particularly for rent, is often seen to offer a better risk-adjusted potential. Indeed, despite short-term challenges posed by covid-19, the private rental sector has been proven resilient in terms of rent collection rates compared with the commercial market. As times of uncertainty increase occupiers’ tendency to rent rather than buy, conditions have even boosted tenant retention in some cases.

Residential space, particularly for rent, is often seen to offer a better risk-adjusted potential

Germany is by far the largest target for residential investment, accounting for over 30% of the market in the past three years. The Netherlands, Spain and Sweden are next in line while larger markets such as the UK and France are moving up as their rental sectors develop. A range of other markets offer strong, sustained liquidity, such as Austria and now Ireland for example, while smaller markets, including central Europe, are also now coming onto investors’ radar.

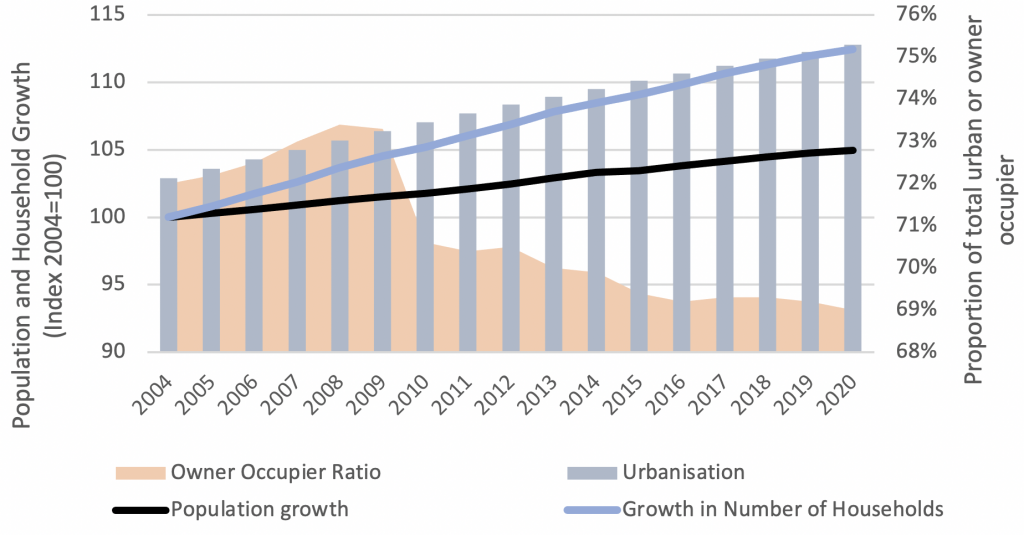

Despite Europe having areas with a declining natural population, the region overall continues to see an expansion in numbers driven by inward migration. More notably, with an ageing, changing and more mobile population, we are seeing yet stronger growth in household numbers – up 0.8% pa since 2004 – more radically changing patterns of housing demand. With urbanisation still rising and the share of the market taken by owner-occupiers in decline, whether by choice or necessity, this is pushing more demand into the rental market.

Hence long-term trends are generally positive drivers of both growth and stability in the sector across Europe. Indeed, if the market matures and professionalises like that in Germany, then combined with demographic trends and changes in supply, the European residential sector could nearly treble in size and overtake offices to become the largest investment sector by 2030.

Drivers of the European residential market for eastern and western Europe

While the outlook is positive, investors need to keep a close eye on strategy and pricing as competition intensifies. Sustainability and affordability need to be high on the agenda, for example, and it is clear that not all residential is created equally: high-rise and high-end does not solve everyone’s housing needs, after all. What is more, regulatory control is in the spotlight and clearly carries a risk for investors, although this should not be exaggerated, with strong tenant protection boosting occupiers’ confidence to rent rather than buy.

Indeed, the bottom line is that demand is driven by a range of factors that deliver better risk-adjusted returns, lower volatility, less correlation to other portfolio assets and higher growth. That potential is also further enhanced by the ability to take control via management, delivering higher revenues with added services.

As a result, opportunities for investors lie in different risk segments, from core to opportunistic, and include both debt and equity provision. Those opportunities will also continue to spread to new cities as investors see that the performance story is an international one.

The march of the beds sector has therefore only just begun so far as European investors are concerned!