While homeowners will pay a premium for their new build properties, a lower percentage of tenants will not. But does the data agree? In this month’s Market Mover, Gav delves deeper into the inconsistencies we’ve found in the ‘new build’ market last month.

Read Time: 3 minutes

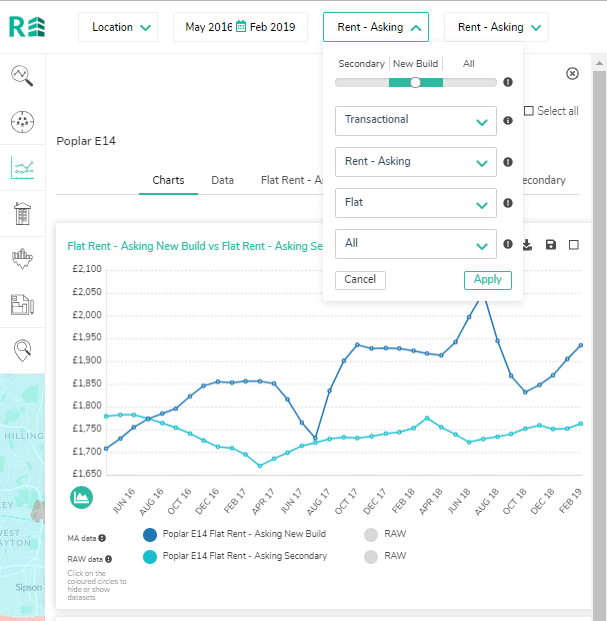

Finding the difference between prices or rents of new build and existing stock is easier than ever using the REalyse platform. In our ‘Analyse’ section, by simply selecting ‘New Build’ with one indicator and then ‘Secondary’ with the same indicator, you can plot them side by side, like so:

One client asked us if we could go a step further, using the REalyse platform to calculate the difference between new build prices and those of secondary stock for every local authority in the UK. And further still: to do so for both rental and for sale properties.

We like rising to a challenge. Within minutes later, we sent them the results.

Now obviously this is quite a valuable piece of information, so it would be amiss to publish it in full here. The results did, however, point out some interesting inconsistencies.

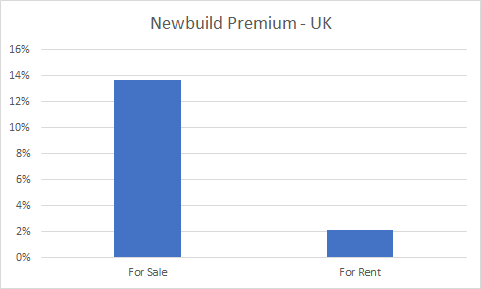

Firstly, there was a significant difference between the premium paid to buy new build properties and the premium paid to rent new build properties. The chart above shows the average premium for new build properties across the 380 local authorities measured in the UK.

It is important to note that we haven’t differentiated between the rents on specialist BTR blocks and the general market, nor have we taken into account different amenities and facilities on offer. Further scrutiny of the resultant data using the REalyse platform would indeed reveal that information needed to answer this. An answer of which would provide a very important piece of information to the BTR market, supposing that tenants were unwilling pay a premium merely because the building is new. Were this the case and higher rents are still being achieved, it is as a result of different amenities or services that are being provided to the tenant, rather than the ‘newness’ of the building as a rental property.

The large premiums paid in the for sale market for new builds have not taken into account the distortionary effects of help-to-buy schemes and so the realistic level of premiums is probably lower. However, the buyer of a new property is likely to price-in the benefits such as the insurance on the construction of the property, modern kitchens, higher energy efficiency, lack of requirement for repairs or refurbishment and less measurable concepts like no one else having lived in the property before.

Conversely, a renter, who is intrinsically transient, is less likely to have as strong a preference for such benefits. Similarly, they are unlikely to accept paying higher rent as an amortization cost for the new items of which they are unlikely to experience full value due to their shorter time spent in that property.

Of the 380 local authorities in the UK, we found that 220 local authorities had a new build premium for rental properties. We also found that 294 local authorities had a lower rental premium than a sales premium. There did not appear to be an obvious explanation as to why some had premiums and others did not, as the locations were geographically and economically diverse.

So, how much will people really pay for a new build property in the UK and is it really worth it? We’ll answer some of that question in a deeper follow up article. To get this article hot off the press and other property insights from the REalyst, head over to REalyseand sign-up to our newsletter.