Originally published March 2021.

Proptech aims to disrupt in multiple ways, but equity markets may hold a clue to the future.

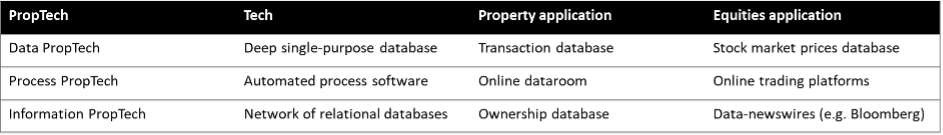

This is the third article in our proptech series. The first looked at how to connect finance and property markets; the second explained how a huge relational database can be created by linking the four quadrants of real estate. In this article we highlight the areas where proptech, which essentially comes in three forms (see below), will disrupt real estate investment markets, and discuss the consequences for the major participants involved.

Segmenting into top-middle-and-bottom

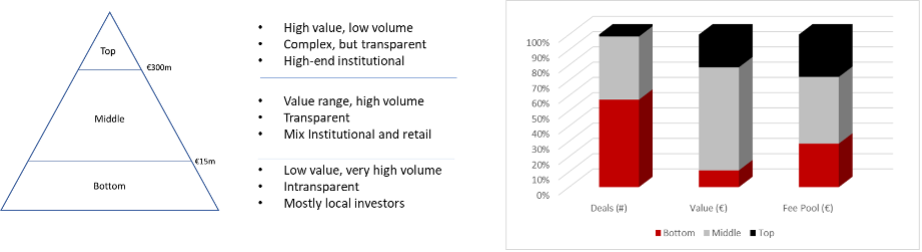

If you take a holistic view of the European commercial direct real estate market, it is broadly split into three segments. The bottom, which we class as transactions with a value of less than €15m, accounts for the largest number of trades, but is by far the smallest by total value. By contrast, the middle has a smaller number of trades, although in value terms accounts for the largest percentage of business. Finally, you have the top segment, which consists of trades over €300m – this has the smallest number of transactions. How will proptech impact each of these areas going forward?

Two problems confront investors at the bottom of the market: the first is a lack of transparency, and the second is high fixed transaction costs. Proptech offers two solutions: Big Data collection will improve transparency, and secondly, the growth of automated platforms will substantially reduce high fixed costs. Just look at what has happened with equity markets. Today you will find that online brokers, like Charles Schwab and Robinhood, have conquered the retail investor base. Trades that used to have a minimum fixed cost are now transacted online for a fraction of that cost – and still make a profit for many of these online brokers. This is a classic example of how the process of technology can deliver huge changes.

There are those who believe that the least disruptive place to be is at the top of the pyramid. The narrative here is that the mega-deals are more resilient to disruption as they tend to be more complex than a straight asset sale, often involving M&A. We disagree. Complex deals need a lot of cross-quadrant data (the subject of our second article in this series) involving analysis of the asset and investigation of the old and new capital structures, as well as evaluating the risk assessments for the lenders. This is exactly where data-driven information proptech will gain a foothold. But at this level data alone will not be enough to succeed. In our second article we argued that, in addition to having the right data, a huge premium will be placed on having the right people to understand and analyse the data. Therefore, those advisory businesses that invest in the best databases, along with the right people, will have a huge advantage over their rivals.

What of the middle? Or the squeezed middle, as some call it. A potted history of the last 30 years of the equity markets tells a story. If you look at the progression of institutional equity broker fees in the ‘mid-market’ over the last 30 years, the first observation is that commission (or fee) levels have almost dissolved. At the turn of the 1990s normal broker fees on institutional transactions were running at between 30 and 50 basis points. Today, trades of this size barely command a fee.

Although part of this fee attrition has been caused by legislative changes, the main factor behind this trend has been automation. This process is well under way in commercial real estate markets. As transparency has improved and the process of selling has become easier, intense competition has increased the pressure to pass on these benefits to the clients. Fee pressure has inevitably led to the mid-market participants moving in two directions – those seeking to invest in low-cost execution platforms; and those moving into the advisory slot in an attempt to command higher fees.

The future for proptech data

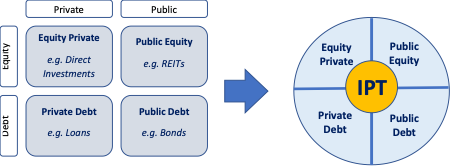

With so many roads leading towards the advisory, or intelligence, route data will become the key to success. And the one key area where proptech really needs to make advances is in breaking down the barriers that exist between the four quadrants of real estate (see below).

In our second article, we discussed the complexities of achieving this and pointed out the fundamental errors committed by the data companies. It will therefore be information proptech (IPT) that will connect everything and allow the Big Data quadrant information to flow through its disjointed infrastructure to players in other quadrants. The result will be that the very same players in each quadrant (managers, investors and service providers) will all benefit from IPT.

The practical application of this technology will allow a bank lender to access a credit score database that measures potential risks to rental income streams. Listed REIT fund managers will be able to assess private deal data, helping them evaluate their stock market valuations. Institutional investors will be able to better assess operational performance, which will give them the confidence to invest in an operating company rather than just buy the property. Fund developers will receive better real estate allocation data, enabling them to adjust new fund characteristics to the latest investor preferences.

Furthermore, it is our view that an ownership database is the best conductor between the four quadrants. Imagine the power vested in the hands of a fund that has data showing every asset with the owner’s name attached, which could then be further harnessed to deliver intelligence from every quadrant – this would deliver the ultimate in competitive advantage. Equally, those advisers with similar capabilities will find that potential clients will beat a path to their door. Proptech is here and everybody needs to up their game.