No signs of capital flight yet.

Just two quick charts on the “Fade America, Long Europe” trade that’s become de jour.

The basic premise is that big bad Trump is ruining America’s reputation as an exceptional place for risk assets, and that as a result, investors are going take their business elsewhere, like Europe, for example.

Now, Random Walk hasn’t remotely thought all of this through, but I’m generally pretty skeptical.

The first reason I’m skeptical is that the premise isn’t quite right: American “exceptionalism” isn’t reputational, it’s structural, both as the ‘Tallest Midget’ and fundamentally, as the place with the biggest, most valuable profit-machines. While the media likes to write stories around its moods, investors aren’t quite as likely to storm off in a huff bc the feels.

The second reason is that Europe is entombed by a thicket of rules, against which the aging and feeble, but once great continent, stands no chance—quite literally, in the sense that the rulemakers are basically tyrants, completely unbeholden to any democratic process.¹

Again, the US is the tallest midget, by a longshot.

Sure, Germany is going to spend a lot on defense, and yes, European central banks are lowering rates, so there will be lots of Euro-denominated debt . . . but it’s still Europe, we’re talking about, and Europe is getting older, and less-dynamic, with every passing day.

Anyways, strong views, weakly held, but I got a kick out of these two charts.

Capital flight where?

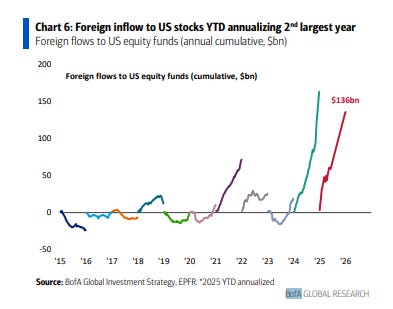

First, if you see the capital flight, please let me know:

Foreign inflows into US stocks is tracking as the second largest year on record.

To repeat, foreign inflows are tracking for the second-largest year ever—all this when foreign investors are supposedly fading the US. It’s still a long-year to go, but if foreign investors are seeking non-US markets to invest in, it’s not showing up in the flows data, yet.

Change in the global reserve currency leaderboard

Second, re. the dollar as the world’s reserve currency, this too is something of a narrative violation.

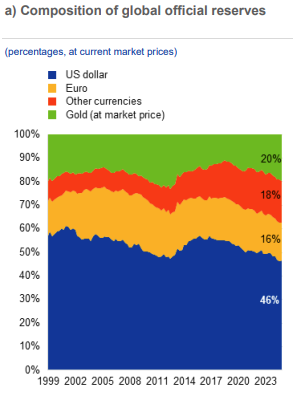

Yes, the dollar’s share of reserve currency has actually been declining for some time, which is something Random Walk has observed in the past.

Recently, there was indeed a change on the central bank reserves leaderboard, but it’s not the dollar that lost a rung.

Gold is now #2, while the Euro slips to third place:

Gold is now ~20% of the world’s officials reserve, second to the dollar, while the Euro slides into third at ~16%.

So much for the Euro bump.

Now, in fairness, Gold’s rise has mostly come at the dollar’s long-running expense—the Euro’s share has been pretty stable. Plus, at least some part of Gold’s rise on the leaderboards has to do with price-appreciation, which has been driven, in part, by central bank buying, but not entirely.

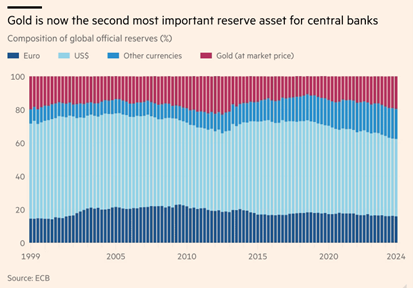

The FT visualises the change thusly:

The Euro has hovered in the high teens since 2014, while the dollar has gradually lost about 10 percentage points over the same period.

But still, a stable share for the Euro isn’t exactly consistent with a bullish Euro shift either. The dollar fade seems pretty on-trend, and the Euro is seeing no sudden warm embrace.

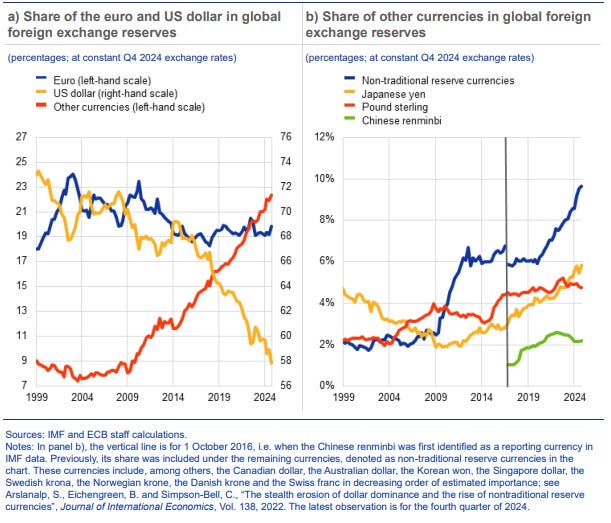

Here, as a % of forex reserves, with exchange rates held constant:

Euro is stable, dollar is fading, and “other currencies” rising.

If anything, the real “winners” of the reserve currency game have been “non-traditional” currencies, including various Krones and Krona. But not the Euro.

Anyways, that’s it.

Random Walk is fading the Fade US, Long Europe trade, and I’m cherry-picking some charts to make my point.

This article was originally published by Random Walk.