UK lending teams reconvening after the summer this autumn and scrutinizing unspent budgets will be looking warily with their credit committees at the challenge of successful deployment in Q4.

Most debt investors would acknowledge that there is simply not as much borrowing as appetite to lend in current market conditions. Limited requirement for secured loans against prime assets bought by overseas investors, and a highly liquid bond market for bigger borrowers, leaves senior lenders with reduced scope for business. Defending the book and harvesting further business from best relationships, at the expense of margin will probably be the story of 2017 for risk-averse banks and insurers, as it was last year.

Certainly, there are few signs that hunger to deploy is overruling risk appetite, and to that extent credit policy makers and risk controllers appear to have an effective handbrake on a peak market creep to poorer assets and looser covenanting to win market share.

Despite all the available liquidity in the debt market (bolstered behind the frontline by strong appetite from secondary investors such as pension funds and Asian banks), we often hear equity investors complain about the struggle to find lenders with latitude to structure loans supportively around an asset improvement plan.

Whilst clearers do still have budgets to fund development, it is limited to a small percentage of the book, and is largely directed at core clients, and de-risked assets, leaving ‘anything spec’ to hedge funds whose flexibility comes at a very high price. Therein lies both the difficulty, and opportunity created by current market conditions and the slightly blunt tool of regulation.

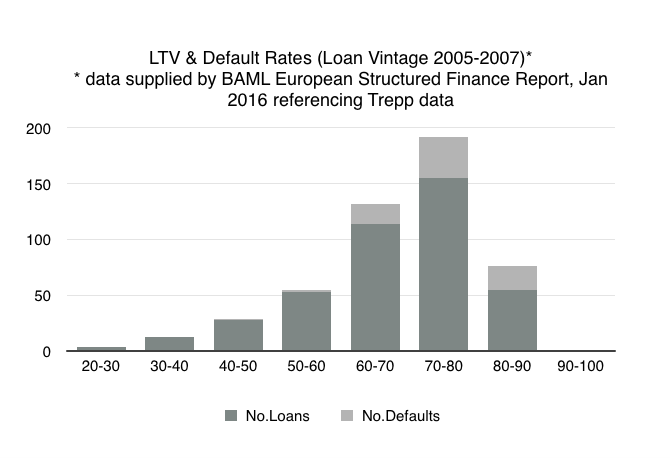

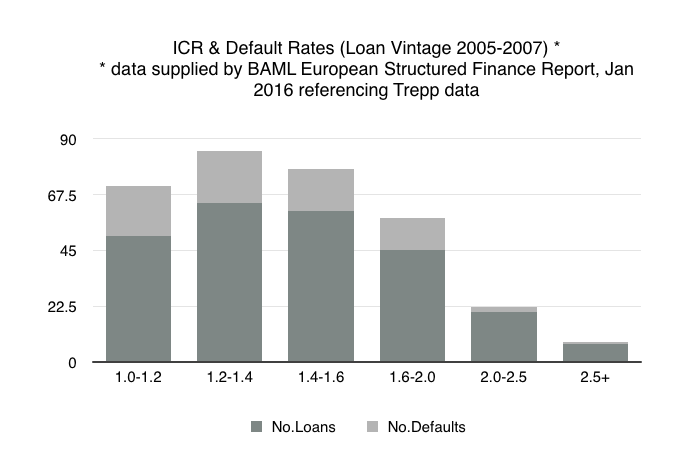

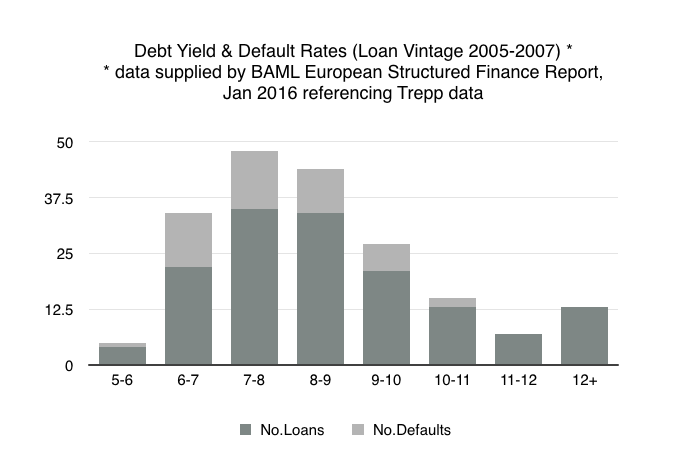

Debt market analysts have pointed to ‘tipping points’ where risk of default rose clearly with indiscriminate market correction during the GFC. Bank of America Merrill Lynch produced some excellent analysis of the drivers of CRE loan losses, highlighting cliffs equating broadly to LTV of 60%, ICRs of 2%x and debt yields at 10%, beyond which defaults rose markedly. Many lenders are now broadly regulated, or internally controlled around these sorts of assumptions.

However, two issues arise from this slightly blanket approach to risk control, which will play out through the next cycle and for which there is no real precedent. Firstly, a whole swathe of capital working broadly to the same parameters has created strong price pressure for loan assets fitting the criteria, and dearth of flexibility within those organisations. Absolute return for senior debt looks weak, and perhaps even weaker against underlying risk assumptions.

Which brings us on to standard covenants and their distortion by prime asset valuations and low interest rates. Can lenders really place value on the three ‘traditional’ criteria when underlying drivers don’t ring true to property fundamentals?

Loan to value – a point in time sentiment – is inflated by prime asset trading to currency investors. Interest cover? Currently masked by exceptionally low interest rates. Debt yield – takes no account possible deterioration in the occupational market. Of course lenders sensitise all these assumptions (pending long term value metric becoming market standard) but realistic forecasting of refinancing risk three to five years from now is challenging.

Using the example of a defensive 50% LTV loan against a £200m prime asset yielding 4%, the interest cost today may be just £2.5m vs £8m of rent, but metrics look very different sensitised against long term value of 5.5% (c£145m) and interest rates 3% higher. The loan still pays, but the value of a very low margin is debatable.

From this position, there may be better value in backing highly capable borrowers to acquire transitional assets at a sensible price and support them to work up the value than back a dry income play with significant risk of value drift over the term of the facility, exacerbated by shortening WAULT. Higher pricing alone doesn’t justify the additional risk, but can look attractive for a loan deployed with managers who demonstrate real ability to improve assets.

Finding the right opportunities in a difficult set of market conditions takes a lot of filtering and an equity approach to underwriting. Patience around structuring is also needed to support asset change. It is a relationship which needs to be highly collaborative, and involved on both sides. This doesn’t suit lenders with a blanket approach to operating large scale business, but at a time when well-rewarded senior loans are rare, it can offer better upside, which an equity investor who feels supported is generally willing to share.