In two days, I’ll drive from South Dakota to Omaha to attend the annual shareholder meeting of Warren Buffett. A great time to pass some investment wisdom from The Oracle of Omaha.

In today’s article, I’ll discuss the top 10 lessons from reading over 5,000 pages (!) of Buffett wisdom.

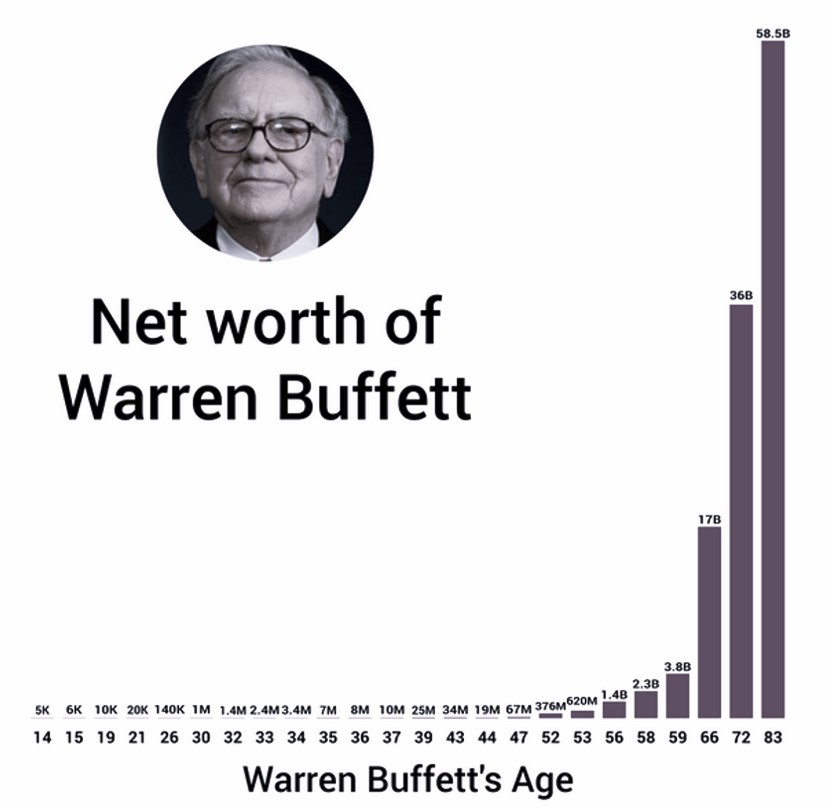

- The longer you invest, the better

Warren Buffett is worth over $150 billion today.

Over 95% (!) of this wealth was created after his 65th birthday.

The power of compounding is beautiful.

- Do not borrow money to invest

This quote says it all:

“My partner Charlie Munger says there are only three ways a smart person can go broke: liquor, ladies and leverage.” – Warren Buffett

- Invest in boring companies

Boring companies are usually great investments.

You should invest in what you understand.

If you don’t understand what you buy, you will not be able to make good and rational investment decisions.

Good investing is like watching paint dry.

An example? If you invested $1.000 in Coca-Cola in 1989 and reinvested all dividends, you would collect over $56.000 (!) in annual dividends. That’s 56 (!) times your initial investment.

- Invest in companies with great management

The incentives of management and shareholders should be aligned.

Invest in companies where insiders own a large percentage of the stock.

Companies with skin in the game tend to outperform:

Why founder-led businesses beat the market – Nelson de Mestre | Livewire

- Buy quality stocks

In the long term, quality always wins.

Stock prices follow the evolution of the intrinsic value.

As a result, you should invest in great companies that can keep growing their intrinsic value.

What should you look for? Companies with a healthy balance sheet and high margins that can grow their earnings attractively.

30 Best Warren Buffet Quotes On Investments, Business & Life

- Be disciplined

Every investment strategy will underperform the market from time to time.

As an investor, you are running a marathon, not a sprint.

Write down your investment goals and stick to the plan.

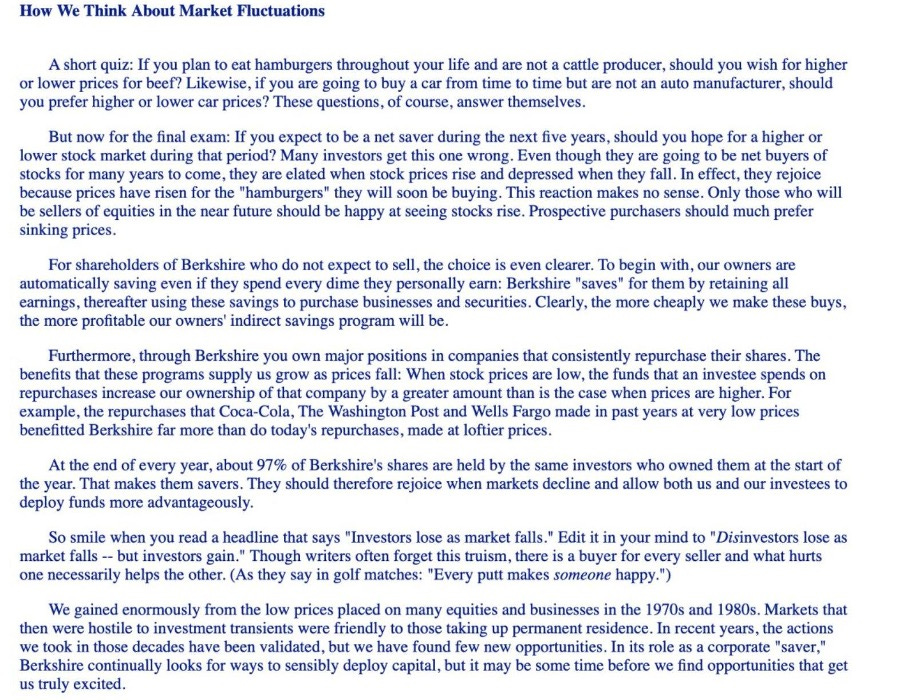

- Volatility is your friend

The best thing that can happen to you as an investor?

Declining stock prices. You can use them to your advantage:

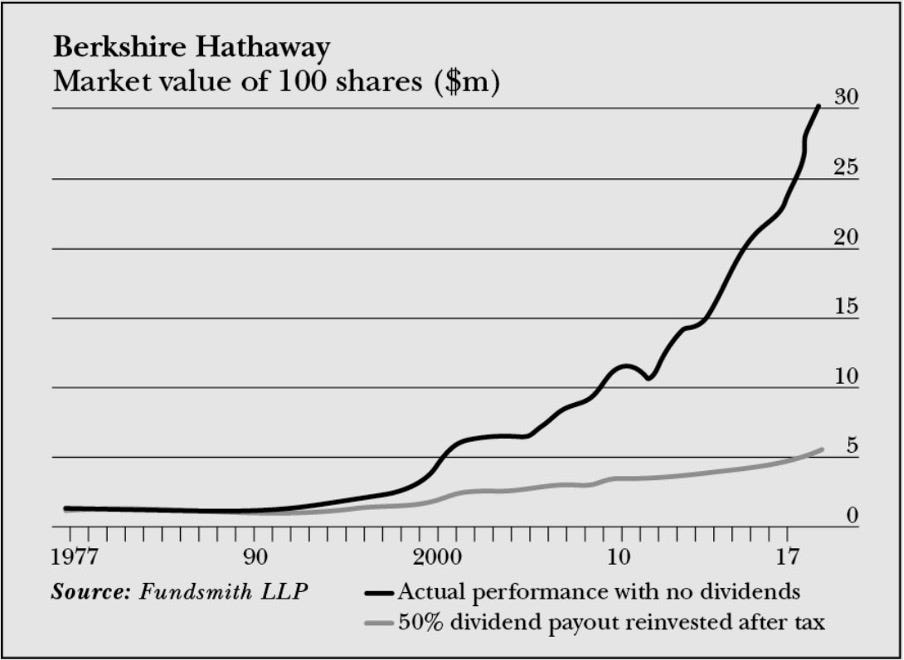

- Plenty of reinvestment opportunities

The golden goose for investors?

A quality stock with plenty of reinvestment opportunities. It’s how Compounding Machines are created.

If you invest in companies that can reinvest their earnings to grow organically for years or even decades, the company’s earnings will explode over time.

- Invest in your best ideas

Your best ideas should have the highest weight in your Portfolio.

It doesn’t make a lot of sense to invest in your 28th-best idea.

Overdiversification (or diworsification) can be harmful to your results

- Pricing power is crucial

You want to invest in companies that have pricing power.

These companies can pass increasing costs to their customers.

Companies with a lot of pricing power are usually characterised by a high and stable Gross Margin. That’s exactly what you want to see.

This article was originally published by Compounding Quality.