We are starting to appreciate some of the damage that the Covid-19 crisis is doing to the economy but in the western world the first warning lights came when stock markets lurched downwards in late February. In the past 6 weeks There has been quite a rally (ironically since the UK went into lockdown on March 23) but at the end of last week (May 1) the FTSE100 index was still 24% down on its end-2019 level. From a property perspective, equities represent an alternative asset that often have a knock-on effect on property values as they would otherwise look expensive relative to equities and both asset classes are reacting to similar market signals.

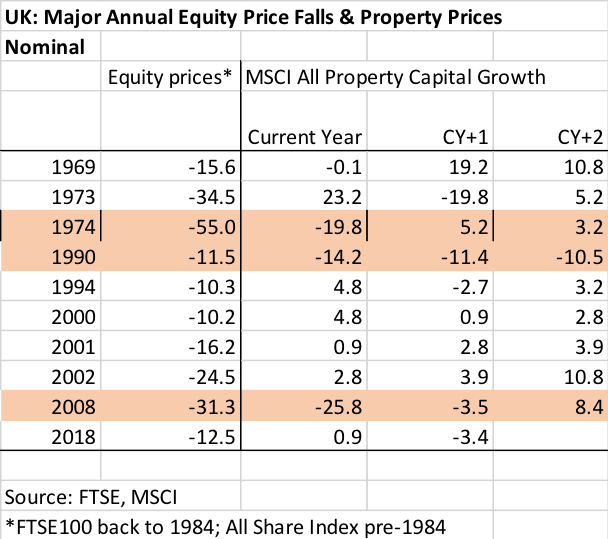

To assess how strong this relationship is we have looked at what has happened to property values when there has been a stock market crash. The rows in Table 1 below show every year in which there has been a double-digit fall in equity prices going back to the devaluation crisis in 1969. The data in the table show the percentage change in equity prices in the year in question and the percentage change in commercial property values in that year and the two subsequent years (CY+1 and CY+2).

Table 1

For example, in 1969 equity prices fell by 15.6% but commercial property values only fell by 0.1% and in the following two years they increased by 19.2% and 10.8% respectively. What Table 1 shows is that in only three of the 10 years since 1969 that have seen double digit equity prices falls have commercial property price fallen by a significant amount. Between 2000 and 2002 when equity prices fell by a cumulative 43%, property values actually increased by a cumulative 8.6% and they continued to rise in the following four years too benefitting from the low interest rate environment ushered in by the .com crash.

The three years that actually conform to the expected relationship are 1974, 1990 and 2008. Following the 1990 and 2008 equity price crashes there were runs of particularly severe falls in commercial property values.

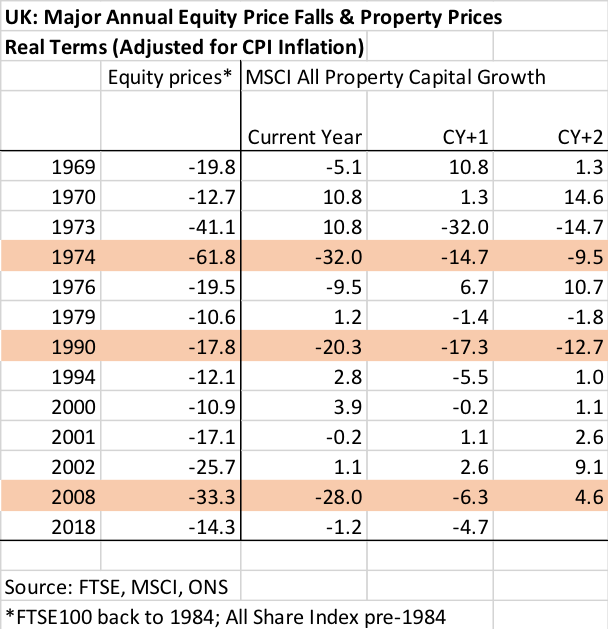

Before delving into why property values fall in some years when equity prices decline materially and not in others, Table 2 looks at the relationship in a slightly more rigorous way by looking at equity and property prices after having allowed for inflation.

Table 2

Looking at the data in real (i.e. inflation adjusted) terms reveals more years when equity prices fell by more than 10% but there are still only three years where commercial property prices also fell by more than 10% in real terms. The three years of 1974, 1990 and 2008 still stand out as the years when property values fell heavily in the same year as an equity price crash.

What marks these three years out for property is the extent to which they were preceded by a major build-up of property debt. As well as the first oil shock, the 1973/74 crash came in the wake of the Barber boom. This saw banks’ lending to commercial property companies more than double in both 1972 and 1973. The result of the downturn was the 1974 commercial property price crash and the secondary banking crisis (the residential lending boom also contributed in no small way to the secondary banking crisis). 1988-89 also saw a lending boom with a 127% increase over the two years and 2005-7 saw a 74% increase in bank lending to property. The run ups to the years where equity prices fell sharply but commercial property values were resilient, by contrast, saw relatively low increases in commercial property debt. It does look as though a build-up of commercial property debt makes property values vulnerable when an equity crash happens. The most likely mechanism being that some highly leveraged investors are forced into forced sales when they get into difficulties with loan servicing and, in some cases, that banking covenants caused direct problems when valuations fell.

So, what of the crash of 2020? To start with, it is important to stress that all property is different and that generalisations will always hide a multitude of detail. In aggregate though, the indicators are promising. There has been no major build-up of bank lending in recent years. Non-bank lending has risen but not fast enough to make up for the weakness in bank lending. Other indicators also point to commercial property not being as highly leveraged as in previous downturns. For example, CBRE data indicates that the typical LTV on senior lending for London offices was 72% in 2007 (76% in 2006) but it was just 55% in 2019. Given also that corporate bond yields, another leading indicator of property values, have not spiked as much as they did in 2008. 2020 may be difficult for commercial property values but it might not turn out to be quite as bad as some commentators think.