Could this year be an inflection point for three key structural trends in the UK and European real estate markets?

The evolution of the European real estate markets is increasingly being influenced by structural trends, in particular the shift to multi-channel distribution, the future of flexible space and the increasingly negative interest rate environment. Technological changes in particular are an important driver: they have not only made a mark on the habits of the younger generations but also seem to be reshaping the behavioural patterns of society in general. The nearly all-encompassing use of mobile phones has changed the way we work, shop and live.

The real estate industry seems to be a late convert to technological progress. It does not rely explicitly on technology and entails informal processes resilient to change, such as the broker-based model for trading commercial real estate. However, consumers have always mattered in real estate. It is not the aesthetics of a building – my apologies to all architects – that drives the value of real estate, but rather the services or goods sought after at a specific location.

The rise of co-working and flexible space, a trend indirectly driven by changes in technology, has changed office markets. In Amsterdam or London, roughly 5% to 6% of office stock is currently occupied by flex space providers, as the more flexible use of space has brought efficiency gains and greater client value in the leasing market. Other cities, while still lagging, seem likely to catch up soon. Technology has also changed the retail and logistics real estate markets, as more than 18% of retail purchases in the UK and 10% on the continent are now done online. As a result, the prospects for retail real estate have become more clouded, but demand for logistics space is rising.

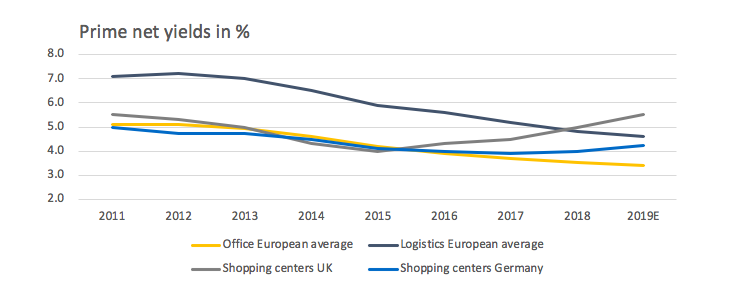

Another key structural trend at work in Europe is the increasingly negative interest-rate environment, which has markedly impacted real estate markets. At the end of the third quarter of 2019, more than $14trn of predominantly European bonds were trading with negative yields. As real estate valuation needs to be considered in a multi-asset-class framework, negative bond yield levels have further raised the appetite of investors for property, leading to higher prices and lower yields in this sector.

However, the departure of Mario Draghi as president of the European Central Bank, the botched IPO of flex space provider WeWork, and the failure of the travel service provider Thomas Cook, together raise the question of whether 2019 may be an inflection point for the three trends of negative interest rates, flex space and multi-channel distribution.

As regards negative interest rates, it is too early to talk about the end of this period. Many major central banks, such as the Reserve Bank of Australia and the US Federal Reserve, eased monetary policy in the course of 2019. The European Central Bank reacted by easing monetary policy further and taking up quantitative easing again. Moreover, it seems the ongoing negative interest rate policy will remain intact with the arrival of Christine Lagarde to take the helm at the bank. So real estate yields seem to be under further downward pressure for now.

The exception is retail properties, where yields have increased sharply in the UK and started to trend upwards on the continent. The UK market is in a difficult situation due to the company voluntary agreements that allow retailers to restructure their liabilities. The failure of Thomas Cook threatened to add further stress to the market, as it occupied more than 555 retail properties in the UK. Those stores are now being taken over by Hays Travel, a Sunderland-based independent travel agent, but this does not change the overall outlook. The structural challenges remain and retail properties in the UK and in continental Europe are expected to see falling valuations for a while.

The last major event affecting structural trends is the situation of WeWork. After the botched IPO, the company seems to be at a watershed. While it is still a matter of speculation what future awaits WeWork, it seems unlikely that the business it will be able to continue its aggressive growth course of past years. Also the question looms of what happens with the current rental agreements the company has signed in recent years. In London it occupies more than 50 buildings and 4m sq. ft of office space, making it the market’s largest private tenant. Were the company unable to honour some of its rental obligations, that might lead to some market uncertainty. Rental growth might be negatively affected over the short term in markets such as London, Manhattan or Amsterdam.

Over the mid-term we remain positive for many of those assets that are well positioned, even as the weaker assets could suffer. There are many other flexible space players that are looking for growth opportunities and might step in. Some landlords would directly approach the underlying corporate tenants, as a few larger landlords have developed in-house flex space operators that might bridge the gap. In our view the flex space revolution won’t be reversed any time soon, even if it would take a while for the markets to absorb such a negative shock of the failure of a dominant provider.

To sum up, structural changes are having a deep impact on the evolution of real estate markets, whether in terms of the shift to multi-channel distribution, the future of flex space or the increasingly negative interest rate environment in Europe. All these trends need to be monitored closely and investments must follow a disciplined research-based approach that takes the opportunities and risks of those trends into account.

Source: PMA, Credit Suisse Asset Management