Unless you are a hermit living in a very remote cave, I’m sure you’re aware of the coronavirus pandemic.

And if you have any interest in investing, then you also probably know that stock markets around the globe have suffered what can only be described as a stock market crash.

Crash is a strong word, but with the FTSE 100 falling 26% (from 7,500 to 5,500) in less than a month it’s hard to call it anything else.

Technically speaking we are now in a bear market, which is somewhat arbitrarily defined as a decline of more than 20% from recent highs.

What does this mean for investors? Should we sell now and hide under a rock, or is there some alternative?

Before we do anything too hasty, let’s look at valuations.

As I write, the FTSE 100 is close to 5,500. That gives it a CAPE ratio (cyclically adjusted PE) of 11.3, well below its average value over the last 30 years of 18.4.

In fact, the FTSE 100’s CAPE ratio is now lower than at any time in the last 30 years, other than at the very bottom of the 2009 crash.

As for the FTSE 100’s dividend yield, it’s fractionally over 6%.

So with valuations at what I would conservatively call “cheap”, what should investors do?

Obviously I can’t tell you what to do, but I know what I’m going to do:

I’m going to keep putting money into the stock market on a regular basis

I’m going to keep looking for high yield, high quality stocks

I’m going to keep focusing on where economies and businesses might be in five or ten years

I’m going to keep ignoring day-to-day volatility

In short, I’m going to keep calm and carry on investing.

To some people that will sound crazy, but here are the assumptions I’m working under:

Coronavirus has a mortality rate of less than 5%, so it isn’t going to be the end of the world.

Within five years I think it’s likely that a) a reasonably successful vaccine will have been developed, approved and deployed, or b) the virus will be so commonplace that most people will have either had it and survived or will have just gotten used to living in a post-coronavirus world.

Given the assumptions above, I think it’s likely that this particular coronavirus will have little impact on the global economy five years from now.

If the economic impact is relatively short-lived (less than five years) then the impact on the long-term prospects of most good businesses will be minimal.

If most economies and most good businesses are back to normal within a few years, then earnings and valuations are likely to be back to normal within a few years as well.

If future earnings and valuations are approximately normal in say five years, then investing today at valuations that are well below normal is likely to produce above average returns over the medium to long-term.

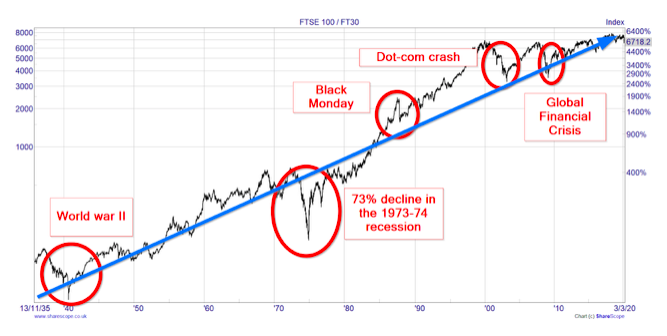

If history tells us anything about this sort of thing, it is that the global economy has always bounced back from previous crises, including the Great Depression, World War II, the recessions of the 1970s, Black Monday in 1987, 9/11 and the dot-com crash and of course the recent Global Financial Crisis.

“It ain’t about how hard you hit. It’s about how hard you can get hit and keep moving forward” – Rocky Balboa

I’ll leave you with a few similar thoughts from someone much wiser than myself:

“During the Depression, the Dow hit its low, 41, on July 8, 1932. Economic conditions, though, kept deteriorating until Franklin D. Roosevelt took office in March 1933. By that time, the market had already advanced 30 percent. Or think back to the early days of World War II, when things were going badly for the United States in Europe and the Pacific. The market hit bottom in April 1942, well before Allied fortunes turned. Again, in the early 1980s, the time to buy stocks was when inflation raged and the economy was in the tank. In short, bad news is an investor’s best friend. It lets you buy a slice of America’s future at a marked-down price.

Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

– Warren Buffett, 2008

“Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%. But, surprise — none of these blockbuster events made the slightest dent in Ben Graham’s investment principles. Nor did they render unsound the negotiated purchases of fine businesses at sensible prices.

Imagine the cost to us, then, if we had let a fear of unknowns cause us to defer or alter the deployment of capital. Indeed, we have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist.”

– Warren Buffett, 1994