I’ve just been listening to a radio interview with Mark Carney, governor of the Bank of England, in which he prevaricated endlessly about whether UK Bank Rate was going to rise. Not specifically in May, but at all. Since taking on the role in 2013, Bank Rate is precisely where he found it: at 0.5 per cent. He maintains that the decision to raise UK interest rates remains finely balanced, with the outcome of Brexit negotiations a key input to the deliberations of the Monetary Policy Committee. I beg to differ. Brexit is as irrelevant to the MPC’s task as the phases of the moon, though admittedly less predictable.

Over the past 8 months, the 2-year yield on US Treasury bonds has virtually doubled from 1.25 per cent to 2.43 per cent. The economy has been firm, Jerome Powell has replaced Janet Yellen and the administration has passed two outrageously expansionary fiscal bills. Bond investors took a view and sold short-dated Treasuries. The members of the Federal Open Market Committee came to work to find the job already done! All that remained was to fill in the paperwork.

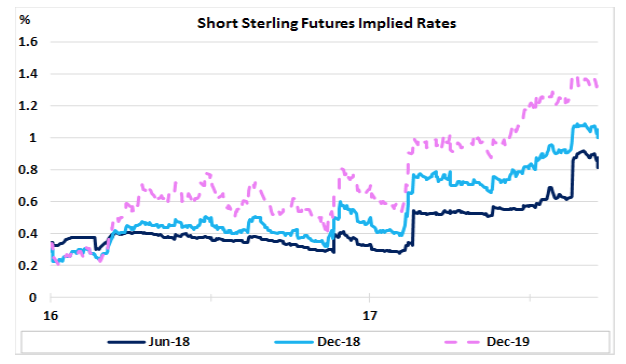

If this is true for the largest economy in the world, and the most influential central bank in the world, what does it tell us about the Bank of England? UK money markets recently revised up their pricing of the end-2019 short-term interest rate to the giddy heights of almost 1.4 per cent (figure 1). At a slight stretch, this would imply 3 quarter-point increases in addition to the much-telegraphed May hike. Are UK money market rates rising because the domestic consumer is in fine fettle? Plainly, not. Are they rising because inflation is above the upper band of the Bank’s target range? Not anymore. In fact, the latest consumer price print, at 2.5 per cent, was a little softer than expected. UK Bank Rate is rising because the global economic engine is purring. The fact that the UK, with Australia, is losing momentum is a detail. The interest rate train has finally left the station.

Figure 1

Is the MPC powerless? Strictly, no; they have the freedom to do something stupid, like the Riksbank in Sweden. The Swedish economy has been performing well and inflation is running close to 2 per cent. But the policymakers reckon that it is too soon to lift interest rates (the benchmark repo rate) from the subterranean level of minus 0.5 per cent, having abandoned a needless programme of central bank asset purchases only last December. The Krona has lost 10 per cent of its value against the Euro since September 2017 and could depreciate further at the slightest hint of hawkishness from the European Central Bank. It seems that central banks founded in the 17th century are prone to delusions of grandeur.

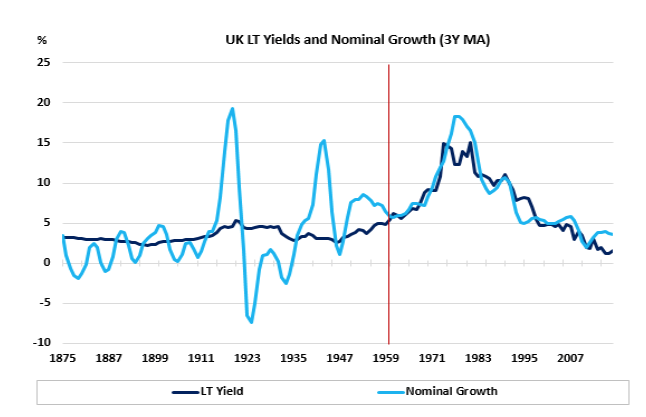

The best place to start, to understand where the structure of interest rates is headed, is the recent growth of the economy in nominal terms. In economics jargon, this is known as nominal gross domestic product (NGDP), which represents the accounting identity of aggregate domestic incomes, aggregate domestic expenditures and the market value of domestic output. Figure 2 presents the history of 10-year gilt yields in relation to NGDP growth. Since around 1960, these two series have enjoyed a very close relationship. Although it is not as obvious visually as the comparable chart for the US, statistical analysis suggests that variations in nominal growth precede those of benchmark yields.

Figure 2: UK long-term yields and nominal GDP growth

Data Source: Homer and Sylla (2005) and Jorda et al. (2017)

Even though there have been signs of slowing in NGDP in the UK over the past year, there is still a sizeable gap between NGDP growth in 2017 of 3.8 per cent and current 10-year gilt yields of 1.5 per cent. If one was extremely pessimistic about the post-Brexit outlook, then it could be argued that NGDP growth will converge on the gilt yield. However, in the context of the strength of the global economy, the more likely resolution appears to be an upward adjustment – possibly an abrupt adjustment – in the whole structure of UK interest rates. The remarkable feature of the investment landscape is how radical a suggestion this appears. If the Brexit talks take a turn for the worse between now and October, then Sterling is unprotected by domestic interest rates, notwithstanding the progress made versus the US Dollar in recent months.

Which brings us to the issue of NGDP targeting. Although the idea is as old as the hills – I can remember the advocacy of Sir Samuel Brittan in the Financial Times in the 1990s – its revival can be dated to the blogs of Scott Sumner and Tyler Cowen in 2009 in the wake of the Great Financial Crisis. Inflation targets didn’t spare us the horrors of the 2007-09 debacle and it is understandable that this policy debate should resume.

One of the key bones of contention is about bygones. For the past 6 years, ever since the US Federal Reserve adopted a formal inflation objective, it has undershot repeatedly its chosen inflation measure. There has been no attempt to recover the undershoot by means of policy adjustment, and so the undershoots have accumulated. One way of rationalising the push for an NGDP target is as a means of making the central bank take its mandate more seriously.

What difference would it have made had the US and UK central banks adopted NGDP growth targets after the GFC? In the US context, emergency policy action would have arrived sooner. NGDP slowed sharply during 2008 – before the collapse of Lehman in the September – and recorded a negative annual growth rate by Q3 of that year. While monthly core CPI inflation was positive throughout 2008 and 2009, NGDP gave a much earlier call to action. A central bank with an explicit NGDP target would have faced justifiably intense pressure to do more and sooner than was the case. Real estate investors would have enjoyed lower borrowing rates from 2008 until at least 2010, and asset prices would have been better supported.

Fast forward to the present and it is clear that central banks should have unwound their quantitative easing programmes and raised interest rates sooner than has been contemplated. The force of global QE constitutes a distortion to all government and corporate bond markets, but especially those of Germany and UK. If the Bank of England had pursued an NGDP target of 5 per cent per annum – and recouped overshoots and undershoots in subsequent years – then this would have paved the way to restore short-term rates to about 2.5 per cent by now, with 10-year gilt yields in the range of 3 to 4 per cent.

Our thesis, based on the available evidence, is that benchmark government bond yields are intimately connected to their nominal environment, both domestically and internationally. It is a mistake to imagine that bond yields are in any sense capped, either by policy preferences or by the pain that would be experienced by those with stretched debt-income ratios. Pain happens.

The successful restraint of nominal interest rates – short and long, government and corporate – in recent years is conditional on the pursuit of ultra-accommodative policies. Now that all vestiges of excuse for maintaining this policy stance have been swept away, it is logical and credible that this appearance of central bank control over the yield curve will be forfeited. Certain investment strategies and styles that have prospered in a world of zero or negative real interest rates and low realised volatility of financial asset prices, will likely founder in their antithesis.

References

Homer and Sylla (2005), A History of Interest Rates, Fourth Edition, Wiley Finance.

Jorda et al. (2017). The Rate of Return on Everything, Working Paper Series, Federal Reserve Bank of San Francisco.