Originally published April 2021.

When thinking about successful emerging market investing, the following quote comes to mind: “In an unfamiliar culture, it is wise to offer no innovations, no suggestions, or lessons.” (Maya Angelou, American poet and civil rights activist).

The notion to watch and learn before arriving at conclusions is particularly important in rather complex socioeconomic environments like emerging markets. So, which lessons have been learned by successful real estate investors in Africa and other emerging market environments?

1) Boots on the ground!

Probably the worst mistake to make when dipping a toe into emerging markets is to rely exclusively on third-party reports and due diligence. As previously discussed, data availability and quality for African markets is rather limited. If available, reports tend to focus on macro themes, whereas a particular real estate project will largely depend on microeconomic data in a particular region, customer group or industry. Hence, targeted sub-market intelligence is necessary at the planning and pre-development stage in order to understand local politics, zoning and planning permissions and, most importantly, infrastructure availability and limitations.

Advice available from well-connected local advisory groups such as Songhai Advisory focused on sub-Saharan markets often provides crucial add-on value for individual projects in addition to the macro views provided by global consultancies.

While the market entry for distribution-focused fast-moving consumer goods (FMCG) players may to some extent be handled using a fly-in-fly-out approach, long-term oriented and capital-intensive real estate and infrastructure projects must have ‘boots on the ground’. Even then it typically takes two to three years to scout out the market and conduct pre-development research.

Trusted local relationships help in setting up targeted vocational training programmes to ensure the availability of an adequately trained workforce

Building local relationships, conducting land bank due diligence (title, environment, encumbrances etc.), evaluating road and electricity availability and quality, understanding existing and developing legislation affecting planning, construction, employment and hard-currency capital flow limitations are only some of the trigger points to be considered.

For corporate owner-occupiers, it may be tempting to use turnkey contracts with the aim of outsourcing (and paying for) a contractor to take care of all the usual troubles. The idea is then to ‘manage’ the project progress remotely with a skeleton corporate real estate team who get on the red-eye from corporate headquarters once in a while and otherwise review the often rather rosy progress reports.

Well, this tends to be an expensive approach.

In the absence of a tried, tested and trusted developer on the ground providing build-to-suit services, hands-on oversight from an experienced in-house team or a trustworthy project management consultancy on the ground helps significantly to re-risk projects.

2) Understand your local partners and stakeholders

Partnerships matter – in Africa and other emerging markets more than elsewhere.

When entering particular countries or sub-markets it is wise to get started by joining forces with local stakeholders and partners like municipalities, landowners or others. This helps in particular at the planning stage of real estate development projects with elements like planning permission, zoning changes and access to utilities. However, it also becomes crucial during the operating phase, in particular for value-add logistics parks which increasingly feature manufacturing elements. Tried and trusted local relationships help in setting up targeted vocational training programmes to ensure the availability of an adequately trained workforce.

Given the impact real estate development projects tend to have on local communities like increased truck traffic in case of a logistics complex, having local partners helps in terms of messaging and getting local buy-in and support.

Joint-venture structures or earn-out arrangements with landowners or municipalities help to align interest and mitigate risks

In my experience, real estate development projects in emerging markets typically involve a much more comprehensive approach. It might be that, for instance, as a condition precedent to issuing construction permits, local authorities require the developer to contribute a school, community centre or electricity substation. In case of industrial developments this may involve additional synergies due to co-development of vocational training centres which will help with workforce recruitment but also the all-important skill transfer. All of this obviously needs to be understood up front and become part of the development plan and project costing.

Joint-venture structures or earn-out arrangements with landowners or municipalities help to align interest beyond the initial land acquisition and project approval stage and mitigate risks associated with a project’s construction, leasing and operation.

3) When in Rome …

Well, that’s a tricky one. Given African markets’ volatility it is advisable to allow local management a larger degree of autonomy compared with developed markets. Naturally this approach provides sleepless nights for compliance departments back at corporate headquarters, especially given the (often unconscious) risk bias about investing in African markets.

For foreign investors an in-depth understanding and adherence to home country regulations like the US Foreign Corrupt Practices Act or the UK’s Bribery Act along with, not least important, applicable host country laws and regulations is obviously vital.

Despite the consistently low rankings of African markets in terms of transparency, if managed properly these risks are not necessarily more pronounced than in other emerging countries

However, I believe that with the right alignment of interest structures for local management and in-country stakeholders along with a capable internal audit and compliance function, these risks are manageable.

Despite the consistently low rankings of African markets in terms of corruption, graft and transparency, if managed properly these risks are not necessarily more pronounced than in other emerging countries. It’s important to understand what’s going on locally and who’s involved before rushing to ‘one size fits all’ conclusions.

4) Road rage

Probably the biggest obstacle to real estate and infrastructure projects in Africa is an inadequate infrastructure. This ranges from unpaved roads that slow down long-distance transport to insufficient bridge capacity to take on heavy loads like construction vehicles, concrete mixers and pumps or supply trucks, and also includes patchy electricity and water access.

Given the significant dependence on imported construction materials, ports and inconsistent customs and handling practices impose additional bottlenecks. For landlocked countries, intra-African border crossings that add a further layer of customs procedures increase these complexities.

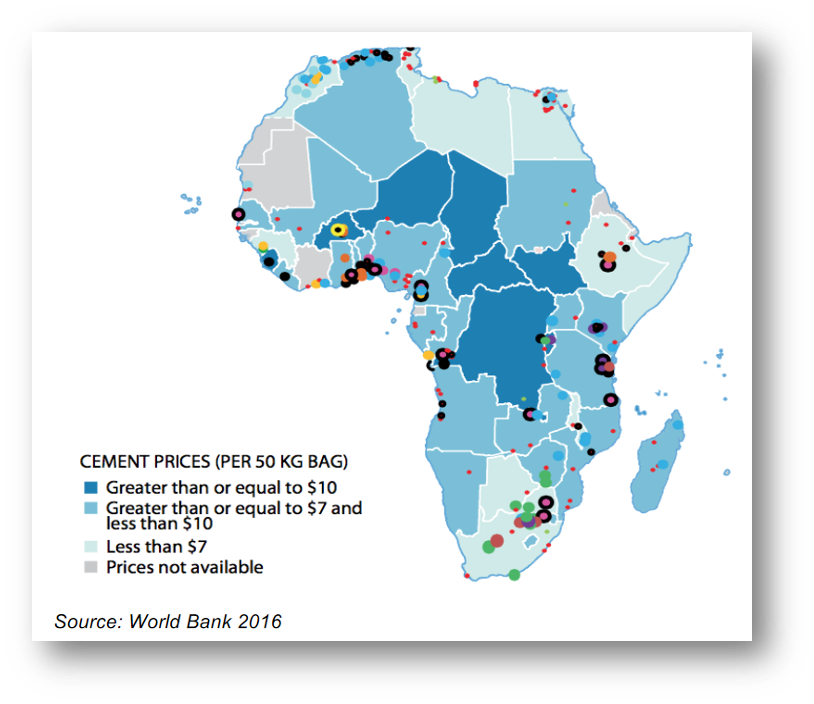

The following distribution of cement prices and production facilities across Africa illustrates the logistical dilemma, but also the related investment opportunities. These price levels average 3x global averages.

The African Continental Free Trade Agreement (AfCFTA) that came into effect at the start of 2021 has brought high expectations that it will help to break down pan-African trade barriers and subsequent costs, not only for real estate and infrastructure projects.

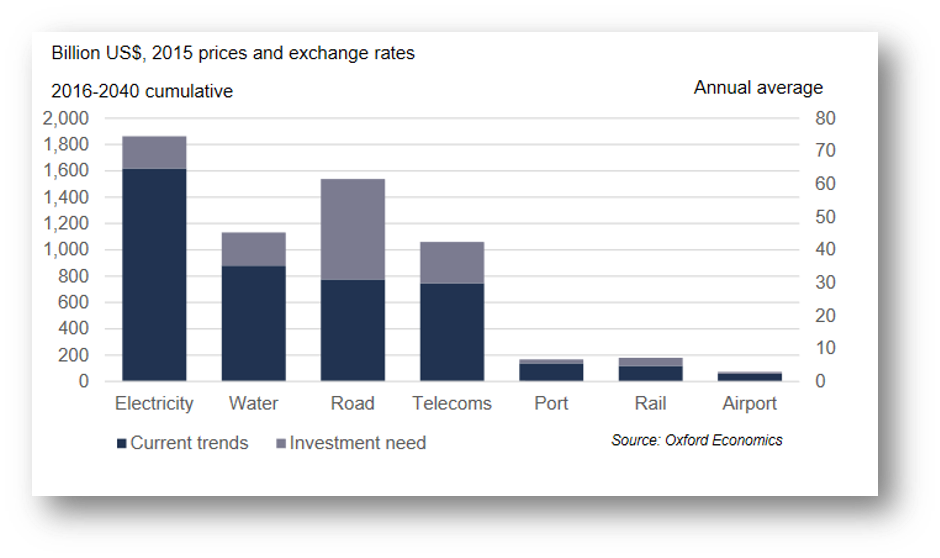

The other partially encouraging sign are current trends of infrastructure spending in Africa during the time period 2016-2040 – see the diagram below, which shows both cumulative (left scale) and annual average (right scale) figures.

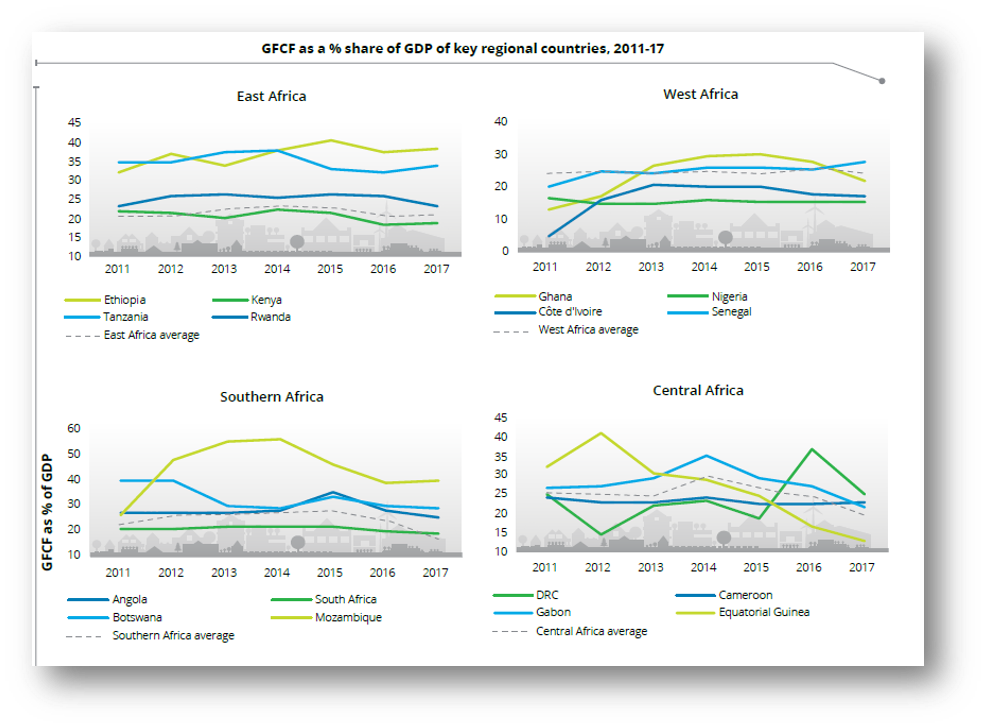

This is also reflected at an individual country level and resembles in some instances the 30%-35% range seen in the early 1980s in China.

Realistic views of timelines, stakeholders and costs involved in addressing those infrastructure limitations during the construction and operation phase (e.g. energy buffers/self-sufficiency) of projects helps to de-risk them. Identifying and employing capable local partners able to navigate these road bumps often proves to be a major success factor.

5) Patience is a virtue

“If you do not have patience, you cannot make beer,” as an Ovambo proverb goes. The rise of the real estate fund management industry has to a certain degree resulted in an increased short-termism driven primarily by fund lifecycles.

In a real estate investment environment like Africa, faced with relatively long lead times and, in the case of natural-resource driven countries, a high degree of cyclicality, the downsides of these short investment horizons become pronounced, resulting in often outsized return impacts.

As argued in my previous introductory piece on African real estate markets, there are various long-term oriented capital pools better suited for these particular market characteristics.

So, where does this leave us?

No doubt, African real estate markets have their specific challenges. However, looking closely shows that these are not insurmountable and are comparable to those faced by real estate investors in markets like China or the former Soviet Union 30 years ago. This sentiment is widely shared among seasoned Africa investors, such as the ex-Goldman chief for Sub-Saharan Africa, Colin Coleman.

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty,” as Winston Churchill once said.

Subsequent articles in this African real estate markets series will look at individual market developments and current opportunities, such as distress sales of shopping malls in West Africa, domestic capital pools as an exit route and the successful shift of labour-intensive industries to East Africa.

I’ll be back!