Who’s right about the best way to reduce child poverty?

Reading through the recent intellectual proxy fight between NYT columnist Nicholas Kristof and Fox News panelist John Tamny (Property Chronicle, 22 March), I couldn’t help but recall a discussion I had with an old US-based friend of mine around last year’s presidential election. He commented on how the domestic US media culture had deteriorated over the last couple of years and how hard is had become to find any unbiased information from most mainstream media outlets.

Considering Kristof’s recent op ed piece, “What can Biden’s Plan Do for Poverty? Look to Bangladesh”, which obviously paints a vastly different picture compared with Tamny’s “Contra Nicholas Kristof, Presidential Ink Will Never ‘Scrub’ Away Poverty”, I thought throwing in a few facts and figures might help.

What’s the big thing in Biden’s $1.9tn ARPA plan?

Ambitiously labelled the ‘American Rescue Plan Act 2021’, or ARPA, its section Subtitle G – Promoting Economic Security (Part 2 Child Tax Credit) is nothing less than an(other) American Revolution. For the first time in American history, it introduces child benefits of $3,000 ($3,600 for children below six) per annum for a wide group of recipients.

Apart from the size of the benefit (previously $1,000 in the form of tax credits only) the truly revolutionary element is the amendment to Section 7527A of the Internal Revenue Code referring to Advance payments: “The Secretary shall establish a program for making periodic payments to taxpayers which, in the aggregate during any calendar year, equal the annual advance […] the term ‘annual advance amount’ means […] the amount (if any) which is estimated by the Secretary as being equal to 50 percent of the amount which would be treated as allowed […] for the taxpayer’s taxable year […]”

So, eligible families or single parents get cash as opposed to ‘just’ a tax credit.

The other enlightening element of the revised child tax credit are the relatively high AGI phase-out amounts. Annual reduction thresholds ($50 reduction per $1,000 excess income) are $150,000 (joint filing), $112,500 (head of household status), $75,000 (single filing status).

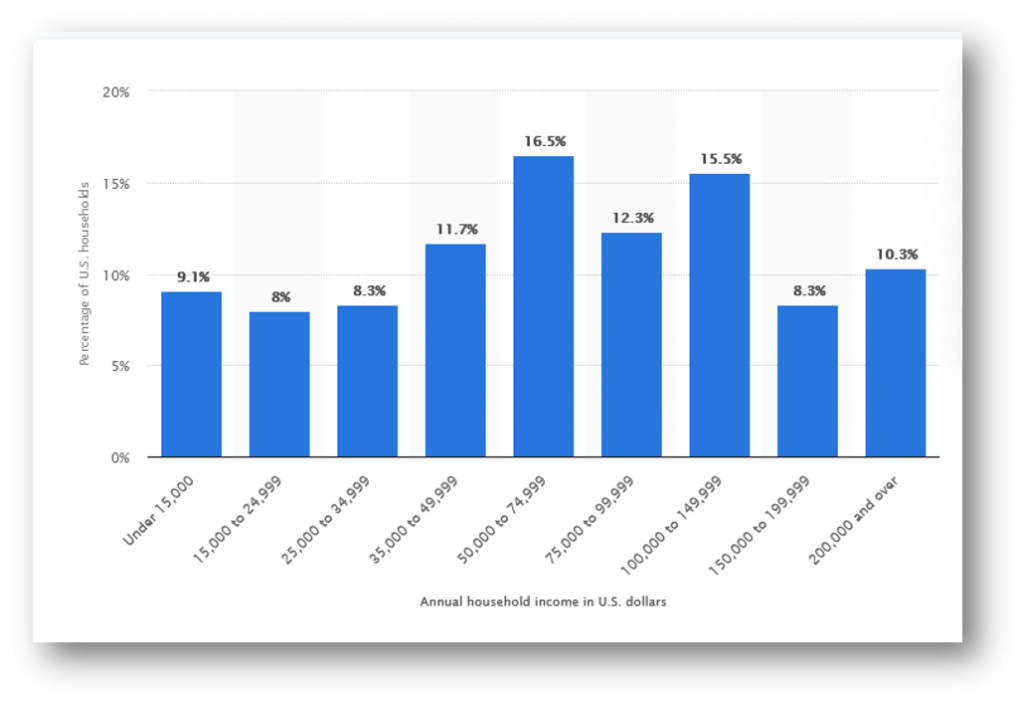

Looking at the percentage distribution of annual household income in the US in 2019 (disregarding AGI adjustments) demonstrates the magnitude of the programme.

US annual household income distribution, 2019

For a family with two kids (aged, say, five and eight) below the $150,000 AGI threshold, the programme translates into an annual tax credit of $6,600 with a corresponding annual cash advance (paid in monthly installments) of $3,300. Comparing this with similar programmes in Europe puts the US in the bottom half of the table.

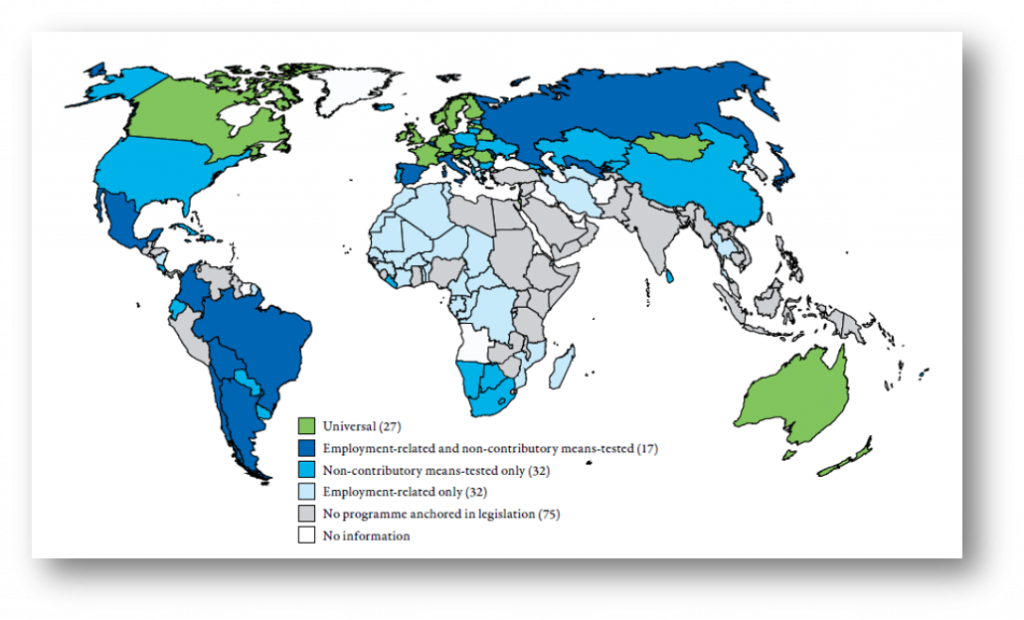

Where did the US stand in the world before 2021?

Child/family allowances – distribution of programmes anchored in legislation as of 2011-13

Given the far-reaching scope of the revised ARPA child benefit programme as well as its characteristics and thresholds, it resembles a form of universal basic income, UBI, which has been discussed by a number of Property Chronicle contributors this year.

What are the arguments in this fight?

So, having looked at legislation and some data, let’s consider the arguments made by the two gentlemen.

Based on a study prepared by Columbia University’s Center on Poverty & Social Policy, Nicholas Kristof argues the Biden administration’s ARPA programme will reduce child poverty in the US by half and as such is on par with Roosevelt’s 1935 Social Security Act (SSA).

Well, looking at the ARPA provisions considered by Columbia University’s study, like the $1,400 ‘helicopter money’ or the $300 per week unemployment benefits, they have one thing in common: they’ll have expired by 31 December 2021.

The only element to be permanent is the $3,000/$3,600 annual child tax credit and its partial availability in the form of advance payments as discussed above.

Hence, it makes perfect sense that the Columbia University study talks about cutting in child poverty in half… in 2021, not permanently. That’s a drastically different legislative outcome compared with the 1935 SSA.

Given the fact that the 2021 calculations are based on a supplemental poverty measure (SPM) framework referring to a 2021 poverty threshold of $28,000 p.a., the long-term child poverty reduction impact of ARPA will be significantly lower than the 50% claimed in the NYT article.

The Bangladesh/US gender equality impact comparison, while important, seems to be misplaced, since the magnitude of the improvement potential in Bangladesh was/is vastly different, as evidenced in the WEF’s 2021 global gender gap report.

Now, let’s turn to John Tamny’s replica arguments. While I concur with his thinking that the 2021 American Rescue Plan Act is rather unlikely to eradicate child poverty, I am sceptical when it comes to his basic ‘Mr. (Free) Market’ argument, which he laid out as follows:

“People create the resources that lead to wealth, and that places poverty in the rear-view mirror. An end to poverty can’t be decreed as Kristof naively presumes; rather poverty’s end is a consequence of enterprising individuals being matched with freedom.”

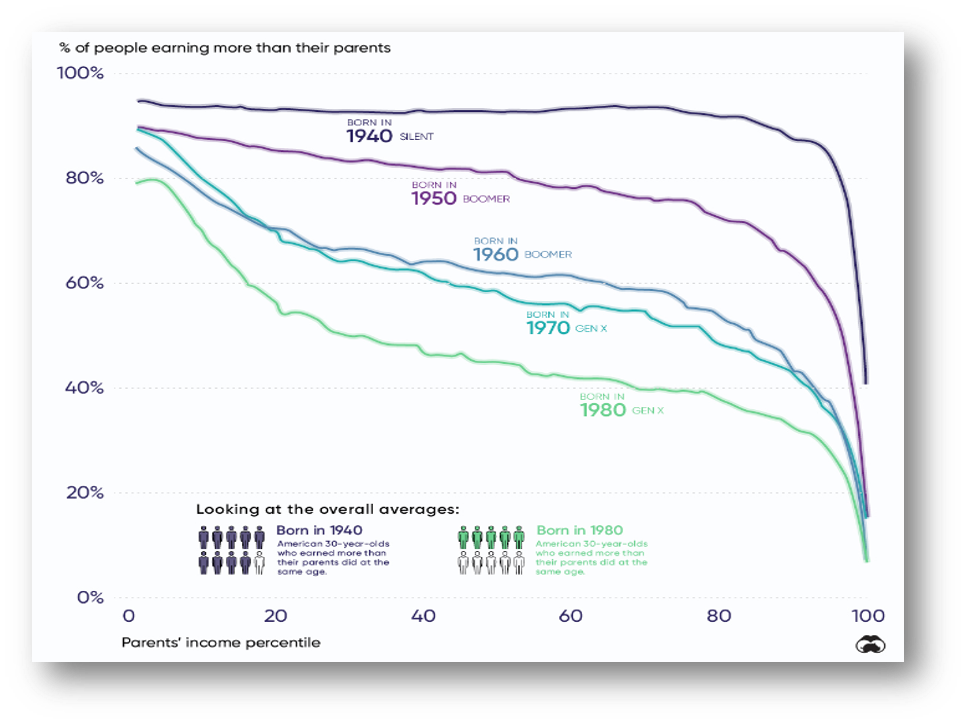

Why? Let’s look at what’s going on in US labour markets over the last few decades.

A) Declining upward mobility (formerly known as ‘the American dream’)

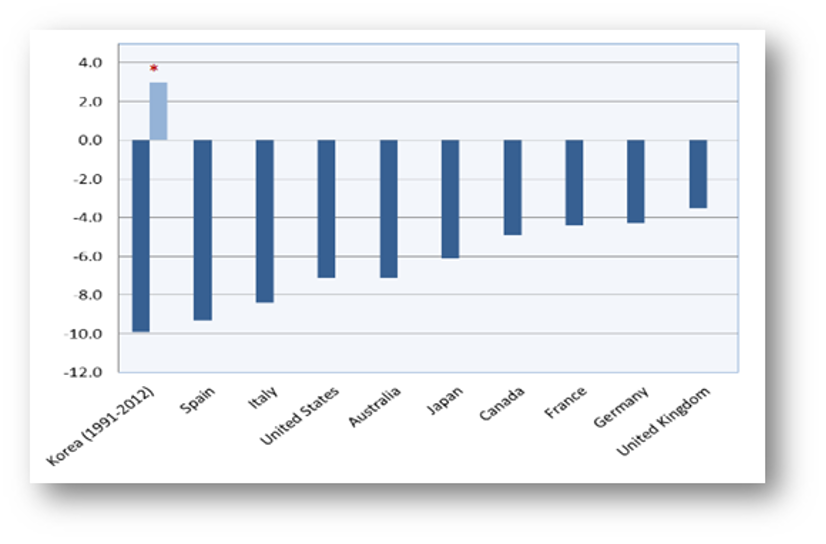

B) Reduced labour (income) share

Changes in labour shares in G20 countries (plus Spain) 1970-2014

C) Rising inequality

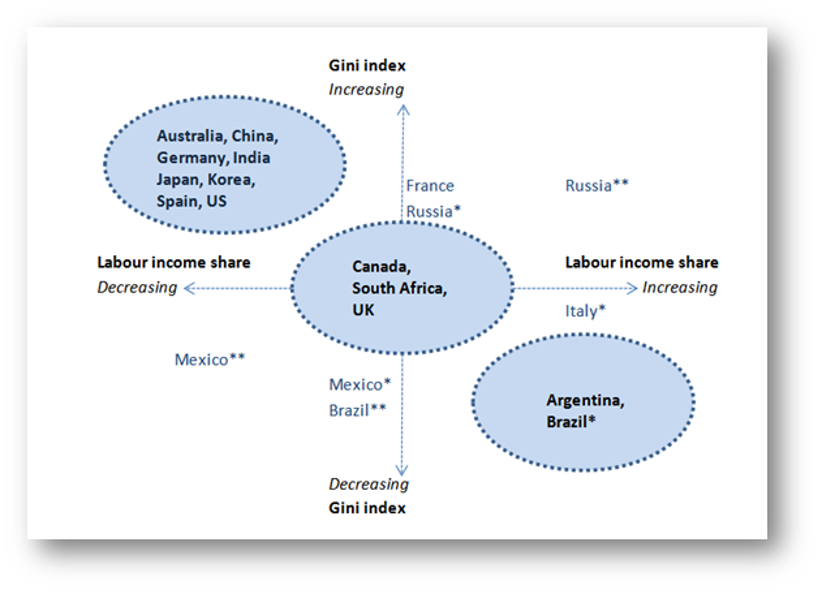

Evolution of the Gini coefficient and labour income share (2000-15)

So, how can we tackle child poverty?

What can be done to avoid disadvantaged kids having to start life’s fight with one arm tied behind their back? ‘Leveling the playing field’ is the magic phrase here.

This can come in various forms and shapes, ranging from supporting quality nurseries, kindergartens and pre-school programmes, to federal support for the public school system, and all the way to financially upgrading state-funded universities catering predominantly to disadvantaged students.

Innovative public ideas such as the Seattle housing choice vouchers are emerging in lieu of simply handing out cash. Particularly interesting are targeted private HNWI actions like MacKenzie Scott’s recent donations of $50m/$40m to Prairie View A&M and Texas A&M International University. Both mainly serve disadvantaged students of colour and, historically, were often underfunded compared with other state-sponsored Texas universities like the UT.

The philanthropic actions taken by MacKenzie Scott and other The Giving Pledge participants, notably the Gates Foundation, speak louder than any verbal argument refuting John Tamny’s claim that: “Enterprise is what erases poverty, not wealth redistribution.”

Looking at what’s happening in the philanthropy space, I’d rather rephrase it thus:“Entrepreneurial and voluntary wealth redistribution along with enterprise has a better shot at erasing poverty than any government programme ever had.”