Much is being said and written about the lack of affordable housing in the UK. Since the trough in the first quarter of 2009 following the financial crisis, the average UK house price has risen by 40%. To buy a home in London, young first time buyers need to save for...

UK residential property has seldom been this cheap

Beware the unannounced interest rate increase

Central banks do not set interest rates. To be specific, central banks in large western democracies with open capital markets and flexible exchange rates do not set interest rates, other than for overnight money. That’s right! If policymakers went on strike – as...

Beware the unannounced interest rate increase

We should be able to control land prices more efficiently

Professor Andrew Baum is one of the UK’s leading property academics, currently Visiting Professor of Management Practice at Oxford University’s Said Business School, responsible for developing the school’s real estate and real assets initiative. He is also chairman of...

We should be able to control land prices more efficiently

Cliff edges and slippery slopes: tough times lie ahead for the UK

For a whole week, the Chancellor of the Exchequer has been out and about on the airwaves of the United Kingdom, attempting to talk up the prospect of a long transitional period for the UK-EU relationship after the UK’s membership of the EU lapses in March 2019. By...

Cliff edges and slippery slopes: tough times lie ahead for the UK

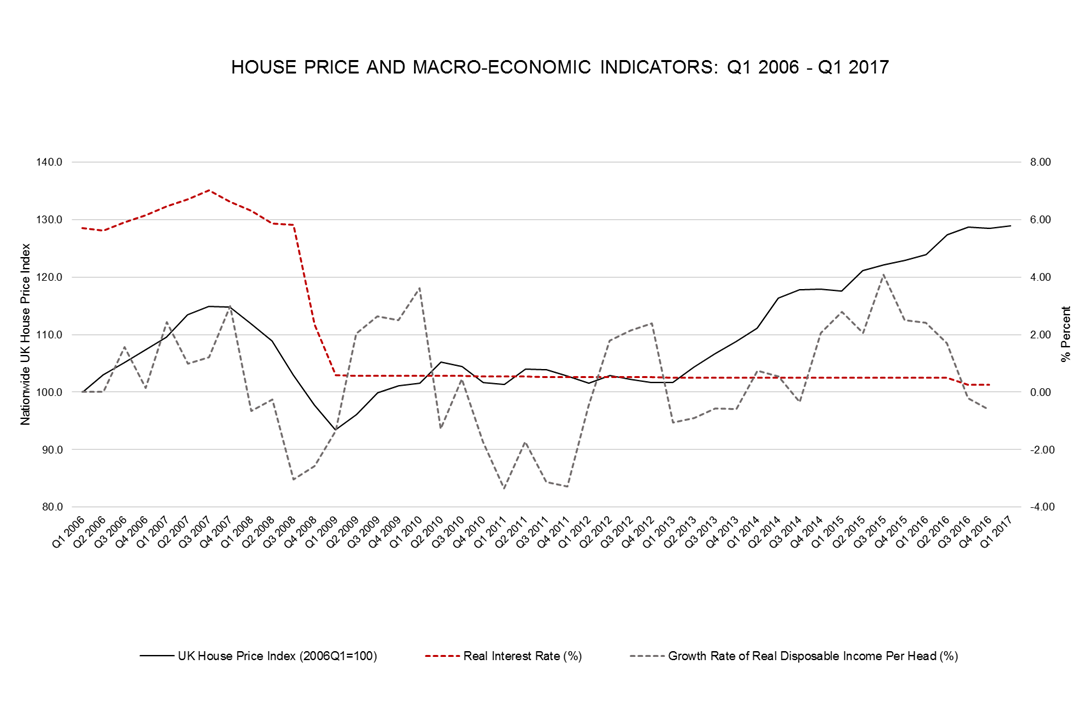

Disposable income: a leading indicator for house price trends?

The chart suggests that the housing market boom since 2013 has not been the result of the low interest rates; instead, real income growth might be a key driver. Our analysis leads us to conclude that real interest rates don’t seem to influence house prices in an...

Disposable income: a leading indicator for house price trends?