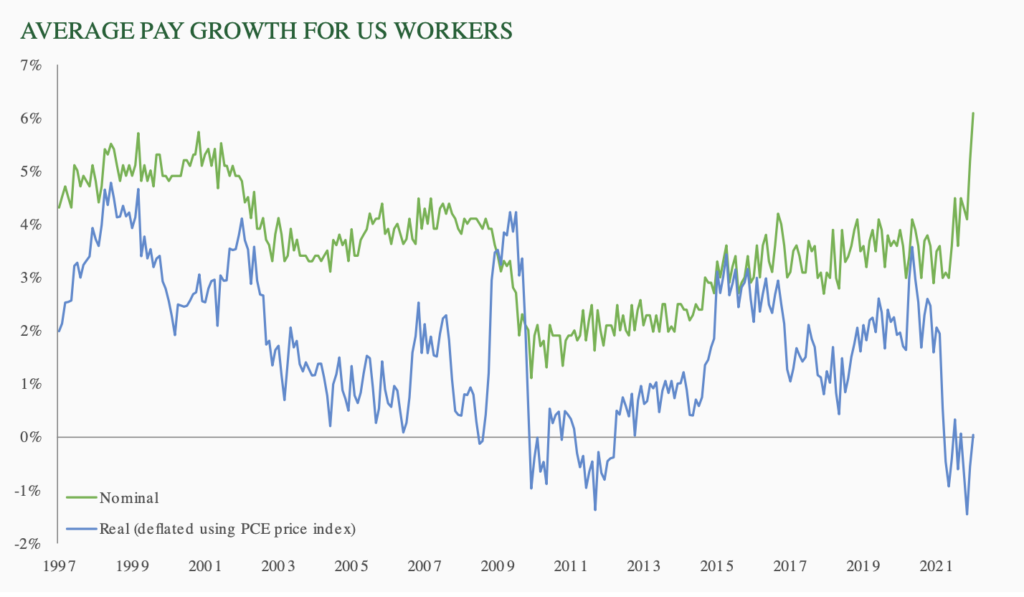

Inflation is running hot, even before wage-price pressures have begun.

Central bankers tell us the current burst of inflation will be transitory and workers will not mind the temporary squeeze on their living standards.

In today’s full employment economy, this is not convincing. The implied policy response is flawed, potentially even reckless.

The US inflation rate is at a 40 year high (US Bureau of Labor Statistics). The Bank of England forecasts UK CPI inflation will hit 7.25% this spring, by far the biggest inflation overshoot since the Monetary Policy Committee (MPC) was created in 1997 (Bank of England (Feb 2022), Monetary Policy Report).