The Federal Reserve System manages the US’s money supply, increasing or decreasing bank credit and other circulating media to reach a target interest rate usually announced at meetings of the Open Market Committee, which meets eight times a year. They met this week, announcing the first of several modest increases in the federal funds rate. To meet this target, the Fed will lower supplies of monetary aggregates until the federal funds rate reaches the desired target. This will primarily be accomplished by open market sales of US Treasury bonds, bills and notes by the Federal Reserve Bank of New York. In order to raise the interest rate, the New York Fed will sell Treasury securities to remove bank reserves from bank balance sheets and this will have a leveraged effect, because any lending based on those reserves will also be removed from circulating as part of the money supply. The greater scarcity of loanable funds held by banks will raise interest rates.

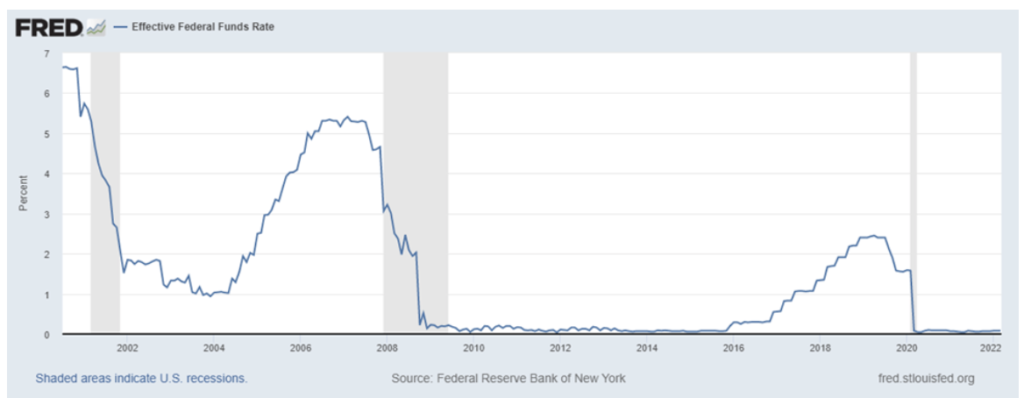

Figure 1: Effective Federal Funds Rate 2000-2022

Figure 1 shows this target interest rate was kept below 2% in the aftermath of the 2001 recession. This mild recession resulted from the bursting of the late 1990s technology bubble. Low interest rates in the 2000s triggered a new boom in real estate, construction, finance and investments, including investments in highly leveraged and non-transparent financial derivatives. Construction began to retrench as early as 2005 and the Fed realised the boom was not sustainable, so they tried to cool it down by raising interest rates. Unfortunately, the overheated real estate and financial markets did not respond right away, and when they finally did, the result was the 2007 financial crisis and the 2007-2009 Great Recession.