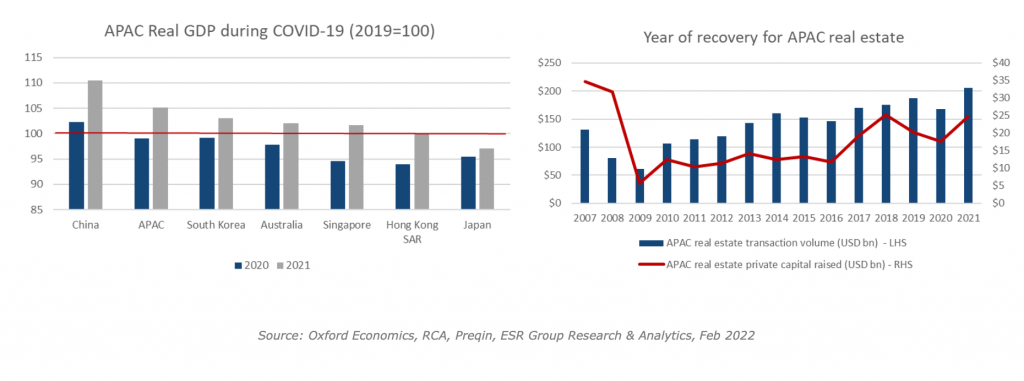

2021 was a year fraught with challenges, ranging from the emergence of new Covid-19 variants to regulatory pressure on China’s property developers. Asia Pacific (APAC) saw an economic recovery despite these downside risks. Preliminary data from Oxford Economics shows APAC’s real GDP in 2021 exceeding that in 2019 by 5.2%. Most major APAC economies have also seen real GDP recover past pre-Covid levels.

Data on APAC’s real estate landscape tells a similar story. Investment in APAC real estate hit a historic annual high in 2021, surpassing the US$200bn mark in one calendar year for the first time. APAC real estate private capital fundraising also experienced a strong rebound, with annual capital raised only narrowly, missing the past decade’s record figure.

Real estate investor sentiment is positive, suggesting that growth is likely to continue despite lingering and emerging headwinds. According to ANREV’s 2022 Investment Intentions Survey, 63% of APAC institutional investors plan to increase their real estate allocation over the next two years, while the remaining 37% expect no change.

With that in mind, we spoke to several of our senior decision-makers for their take on the most promising investment opportunities in APAC, as well as the key risks that investors will need to remain mindful of.

Riding on the new economy

The new economy has been a rising trend that will keep gaining momentum in APAC, benefitting demand for certain real estate asset classes. Data from the International Telecommunications Union indicates that various APAC economies have achieved a level of digitisation comparable to developed Western nations. Meanwhile, the internet user base of countries like China has substantial potential for growth given the large population and relatively low internet penetration.

We expect logistics assets to continue to be a key beneficiary of APAC’s digitisation. Continual population growth, rising affluence, and high levels of internet users have turned the region into a hotbed for e-commerce. The latest available data shows that APAC is the world’s leading region for e-commerce sales by a significant margin, largely due to China’s sizeable e-commerce industry.

China, Australia and South Korea are key markets for logistics, where all are seeing robust e-commerce and investment activity. Another promising market is Thailand. According to Jai Mirpuri, ESR Country Head of Singapore (Development) & Thailand, the country has a favourable environment where currency volatility is low, and yield spreads are healthy. He adds that demand is also likely to benefit from positive e-commerce prospects and infrastructure investment. Railway connectivity with China via Laos is expected to link supply chains to Thailand’s ports across the region.

Cold storage is another asset type worth keeping a finger on. Moses Song, CEO of ARA, opines that logistics will still be the hot sector but it’s becoming more of a land banking play. “Cap rates on stabilised portfolios are very low, and given the inflationary environment, there’s a serious risk that the leases currently locked in will be on the low side in the next few years. Perhaps a more specialised focus in cold chain logistics might be better as that’s still in heavy demand,” he added. Indeed, cold storage has seen an upswing in demand driven by the robust growth of the online grocery industry, which the COVID-19 pandemic has further accelerated. Data from Forrester shows online grocery was the fastest-growing APAC e-commerce subsector in 2020, with annual sales expanding at 46%. The subsector is forecasted to continue to lead e-commerce growth through 2025 (Robert Stockdill, Sep 8, 2021, Online retailers in Asia Pacific drew 154 million new customers last year. Inside Retail. https://insideretail.asia/2021/09/08/online-retailers-in-asia-pacific-drew-154-million-new-customers-last-year/).

Concurring with Moses’ view, Head of ARA China Alvin Loo remarked that the primary focus in China is on New Economy sectors i.e. logistics and business parks, with additional focus on strategic sub-sectors such as cold chain logistics. Logistics and business parks are beneficiaries of the Covid-19 pandemic and China’s drive to be more self-sufficient.