A new golden age looms.

Retail has been at the epicentre of cyclical and structural change. Prior to Covid 19, the sector was grappling with rapid ecommerce growth and changing consumer habits. The pandemic compounded those challenges, resulting in severe impacts on occupancy, rental collection and market sentiment. Look closer though, and pockets of resilience do exist. Many occupiers have not only survived but thrived over the past two years. With the pandemic becoming endemic, a golden age beckons for future-proofed physical retail formats, assets and locations, and informed investors who position their strategies accordingly.

Immediate impacts were pronounced

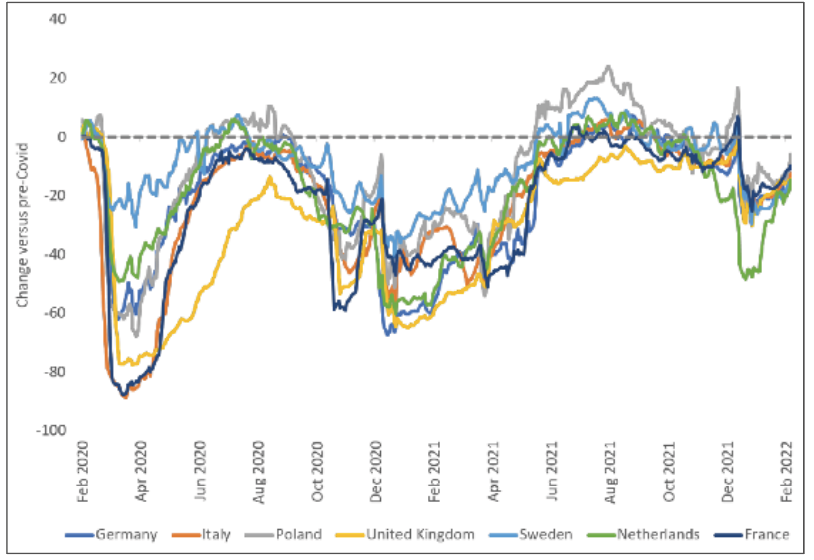

The pandemic had an immediate and dramatic impact on physical retail. Non-essential retailers were forced to close and high-street footfall collapsed (figure 1). Ecommerce penetration rates increased significantly. Retail capital values fell markedly in most European countries. Even with restrictions easing, lingering virus concerns, social-distancing requirements and homeworking mandates continue to depress footfall. Market sentiment remains weak.

Figure 1: Retail & recreation mobility: Footfall has yet to recover

The future is bright

As with other sectors, the pandemic merely hastened structural changes to shopping patterns. These would have eventually occurred over a longer period, prolonging the pain for occupiers and investors. The necessary pain has largely now been realised. Capital values have corrected, rents have rebased on formats previously misaligned to the future and retailers who would have closed anyway are gone. Freed from these constraints, retail is well positioned for a revival supported by three powerful forces: consumer demand, occupier demand and dynamic supply.