Originally published October 2022.

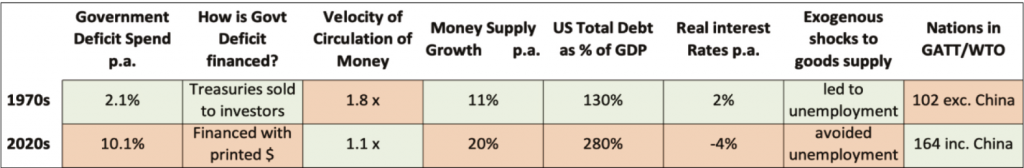

A comparison of today’s inflation context vs that of 1970s.

Most economists work for financial firms and their interests are served if markets expect low interest rates. Perhaps for this reason, these folk have tended to opine (incorrectly) that inflation would not become an issue. I have the opposite conflict. Since farmland is likely to significantly out-perform in times of inflation (see https://www.craigmore.com/commentaries/the-return-of-the-land/) I have an incentive to predict inflation, since this may prompt investors to allocate to Craigmore’s farming and forestry partnerships. My readers will need to judge whether my inflation forecasts of 2020 (https://www.craigmore.com/commentaries/exploring-inflation-risks/) and hereunder turn out to be as inaccurate as those of mainstream economists.

Inflation factors in the 1970s vs todays

When researching this piece, I was shocked to discover how comparatively poor current US policy settings are relative to the 70s.

The table below shows that six key inflation factors are now worse (red) and only two factors (green) are better than they were in the 70s.

Those factors ranking more poorly now than in the 70s are:

Average US government deficit: in the three years to 2022, there will be average US government deficits of over 10% of GDP compared to an average of 2.1% in the 70s. The CBO estimates 5% deficits for the remainder of the decade, still twice the level of the 1970s.

How are government deficits financed? In 2020-2021, the US financed its government deficits by central bank money printing. In the 1970s, the US government financed its deficits the old-fashioned way – by issuing bonds to investors. While the quantitative tightening that began this year is in fact ‘un-printing’ some of the Fed’s balance sheet, a large genie still needs to be put back in the bottle (see FRED graph below).