It is axiomatic of crises that things happen too quickly for decision makers to be able to plan ahead. Well they better be planning now. Desperate measures, little different to those used 102 years ago, have bought governments a second opportunity to deal with Covid-19 in a smarter fashion by building a better toolkit.

An engineer would define a national lock-down as a failure mode – no one would choose this option if they had a broader set of tools. We must hope governments are planning for a smarter ways to control the next round of infections at the local level. To move away from being forced to pretend everyone is infected and focus on those that are or are vulnerable.

The stakes are much higher if indeed we are to get a second chance.

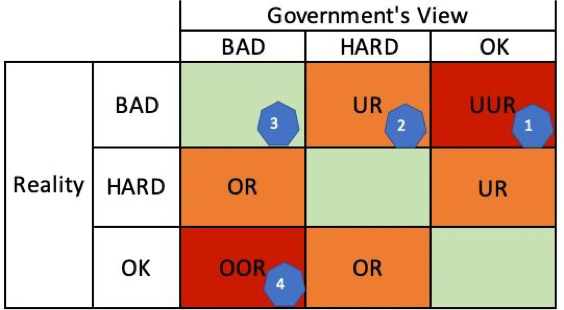

How did we end up in this failure mode? A simple decision matrix illuminates the path.

The matrix is set up as follows. Government, based on advice, makes a decision: Is the Covid-19 break out going to be OK, Hard, or Bad? The world then stress tests that view.

The only way to understand how we got to full lock down is that, for whatever reason (advice or political decision), the initial view was that things were either OK or that there was no point in preparing for Bad (i.e. accept herd immunity through infection). That puts us in the OK column.

The reality started in the OK row, moving through to Hard and finally toward projections of Bad.