Summary

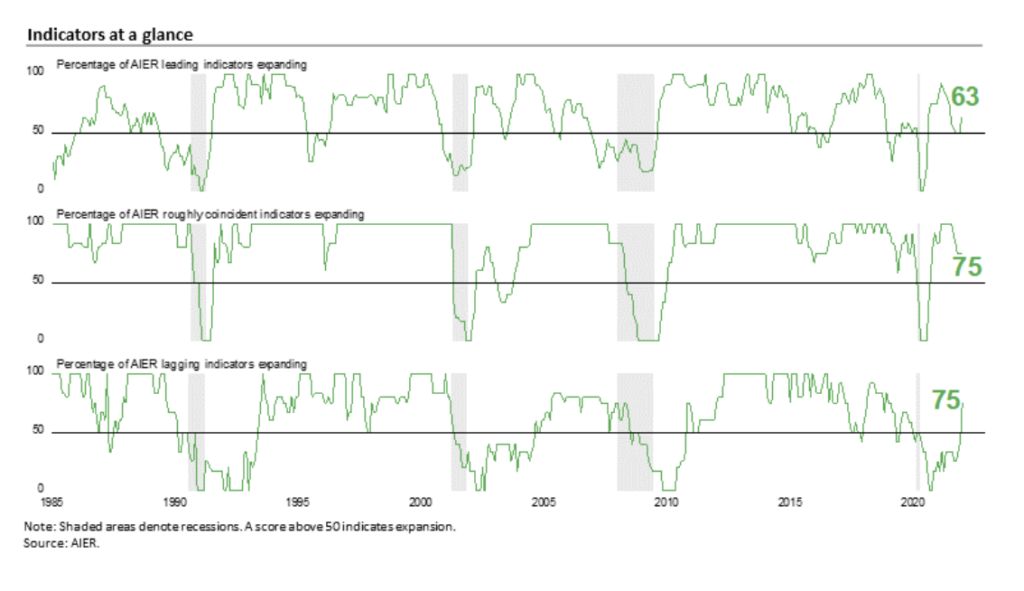

AIER’s Leading Indicators Index posted a solid gain in January, rising to 63 following three consecutive months at the neutral 50 mark. The gain was the largest one-month increase since September 2020, leaving the index at its highest level since July 2021. The Roughly Coincident Indicators Index was unchanged again in January, holding at 75 for a third consecutive month, while the Lagging Indicators Index posted a 33-point gain, the largest since November 2010, and is at its highest level since February 2019 (see chart). January was the first month since December 2019 that all three AIER business cycle indicators were above the neutral 50 threshold.

The positive result for the AIER Leading Indicators Index suggests continued economic expansion with the potential for a broadening of growth in the economy. However, risks remain elevated as upward price pressures continue due to ongoing production bottlenecks, labour and materials shortages and logistical problems. In addition, Fed policymakers are likely to embark on a tightening cycle beginning in March, raising the risk of a policy mistake. Furthermore, 2022 is a Congressional election year and may lead to unexpected events, given the intensely bitter partisan atmosphere and a deeply divided populace.

AIER Leading Indicators Index Rises to 63 in January

The AIER Leading Indicators index posted its largest monthly gain since September 2020, rising 13 points in January to 63. The January result is the highest level since July 2021 and follows three consecutive months at the neutral 50 level.

Four leading indicators changed signal in January: the real retail sales indicator weakened from a neutral trend to a negative trend, but was more than offset by improvements in the treasury yield spread indicator (neutral to positive), the housing permits indicator (negative to positive) and the heavy truck unit sales indicator (negative to neutral). In total among the 12 leading indicators, seven were in a positive trend in January while four were trending lower and one was trending flat or neutral. Initial claims for unemployment benefits, manufacturing and trade sales to inventory ratio, real new orders for core capital goods, real stock prices and debit balances in margin accounts were the five indicators maintaining favourable trends, while the average workweek in manufacturing, the University of Michigan Index of Consumer Expectations, and real new orders for consumer goods indicators all remained in unfavourable trends.

The Roughly Coincident Indicators index was unchanged in January, holding at 75 for a third consecutive month. Overall, four indicators were trending higher: nonfarm payrolls, employment-to-population ratio, industrial production, and real personal income excluding transfers. One roughly coincident indicator, consumer confidence in the present situation, was trending lower, while the real manufacturing and trade sales indicator remained in a neutral trend.

AIER’s Lagging Indicators index increased to 75 in January, up from 42 in December, 33 in November, and 25 in October. January was the first month above neutral since December 2019, ending a run of 24 consecutive months at or below neutral. Three lagging indicators showed improvement in January, with commercial and industrial loans outstanding and real manufacturing and trade inventories improving to a positive trend while the composite short-term interest rates indicator improved from an unfavorable trend to a neutral trend. Overall, four indicators were in favorable trends, one indicator had an unfavorable trend, and one had a neutral trend.

“Businesses remain focused on improving supply chains and expanding production and are likely to make progress once the wave of new Covid cases crests”

Overall, ongoing disruptions to labour supply and production, rising costs and shortages of materials, and logistics and transportation bottlenecks continue to exert upward pressure on prices. Furthermore, continued waves of new Covid cases likely exacerbated these problems in late December and January. Businesses remain focused on improving supply chains and expanding production and are likely to make progress once the wave of new Covid cases crests.

Some recent data reports suggest there may be some progress being made already on the production side while somewhat slower consumer spending could help bring supply and demand back to balance more quickly and help reduce price pressures. The weaker trend for real retail sales (AIER Leading Indicator), positive trend for industrial production (AIER Roughly Coincident Indicator), neutral trend for real manufacturing and trade sales (AIER Roughly Coincident Indicator), and positive trend for real manufacturing and trade inventories (AIER Lagging Indicator) provide some basis for optimism. Even with some easing, a shortage of labor may persist for some time.

Inventory accumulation boosts real GDP growth in the fourth quarter

Real gross domestic product increased at a 6.9% annualised rate in the fourth quarter, up from a 2.3% pace in the third quarter. Over the past four quarters, real gross domestic product is up 5.5%, putting the level slightly above trend.