Once a month we will bring you an interesting chart with a short commentary. Our aim is to illuminate the corners of financial markets.

This time really is different – US unemployment is ‘off the scale’

The sheer scale of the economic heart attack caused by COVID-19 can be difficult to grasp, especially when the sun is shining and lockdowns are starting to ease.

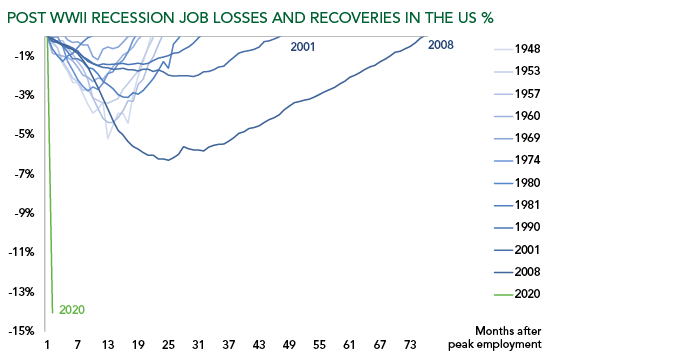

But this month’s chart of job losses and recoveries in US recessions since the Second World War brings home the enormity of the damage.

For years we worried about the record job losses, and then the slow recovery, following the 2008 financial crisis. Now that looks tame compared to the sudden stop caused by the pandemic.