MedicX Fund is a specialist REIT. Like its peers, Primary Health Properties and Assura, it invests in primary healthcare property, focusing on modern, purpose-built primary healthcare assets. The key features of this specialist market are long leases, strong tenant covenants, consistently high occupancy levels and, in the UK, rent reviews that are effectively upwards only. MedicX is invested primarily in the UK but also, to a growing extent, in the Republic of Ireland (RoI) where market dynamics are similar to the UK but rental yields are materially higher. The properties in the MedicX portfolio are let mainly to government-funded tenants (c 90%) and pharmacies (c 8%) on long leases.

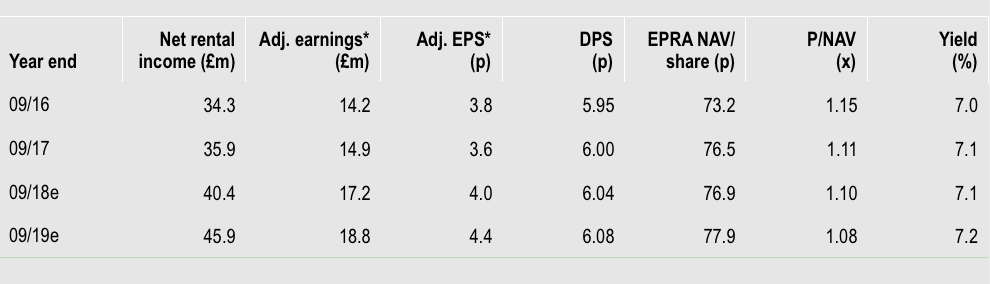

Note: *Adjusted earnings and EPS exclude deferred taxation, revaluation gains, performance fees and exceptional items. Priced as 19th December 2017.

Primary healthcare assets form part of the core healthcare infrastructure, for which there is an increasing need. They provide long-term secure and rising cash flows to support high and growing dividend distributions. Both the NHS and the HSE seek to increase the range of services that GPs are able to provide in local community settings, outside of the hospital system, and integrated with other healthcare services. In the UK, the strategy for change was set out in the NHS Five Year Forward View and Sustainability and Transformation plans, and cross-party support for these remains in place. Sir Robert Naylor’s review of NHS property and estates (published in March 2017) highlights the important role that the private sector can play in driving forward the desired changes. The recent autumn budget has made available additional resources for NHS capital investment. Independently, GPs are increasingly open to working collaboratively in larger groups so that they can provide enhanced services from typically larger, modern and purpose-built premises. The RoI faces similar demographic pressure and the Irish government continues to support the Primary Care Strategy, aimed at delivering similar modern, high-quality premises within local communities.