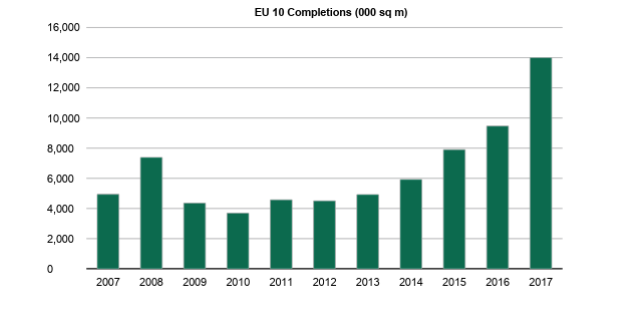

New warehouse supply has reacted robustly to the current strength of demand in Europe. As a result, completions have recently reached nearly double the levels at the height of the last cycle. We address here whether there is a risk that future supply could produce a surplus, or whether take-up will continue to be sufficient to absorb the space delivered, especially as the vast majority is built to suit, not speculative.

Completions are at record levels

Completions have been steadily recovering since 2011, exceeding the previous cyclical peak in 2015. In 2017 delivery of new space outstripped the record level of 2016 in the first nine months alone. In the ten core markets (UK, France, Germany, Netherlands, Spain, Italy, Poland, Hungary, Belgium, Czech Republic) there was c.14m sqm of new space delivered last year, nearly double the annual total in 2008.

Source: CBRE Research

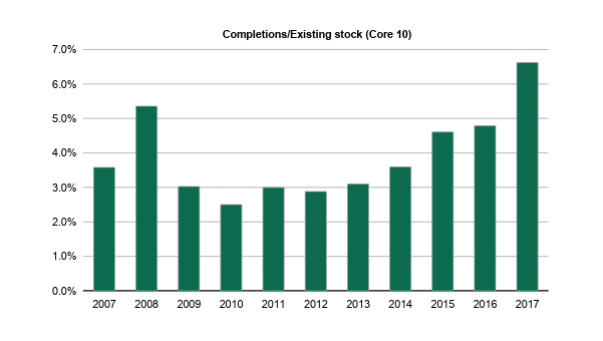

To put this in context, completions as a percentage of existing stock have also surpassed the previous peak of 5.4% in 2008. They exceeded 5% in the first nine months of 2017 alone, continuing the upward trajectory since 2012, to reach 6.5% for last year. It seems likely the previous peak will be exceeded again in 2018, given the current pipeline.

Source: CBRE Research

Demand still exceeds supply, even where deliveries are highest

However, the situation varies hugely depending on the country. As the chart below shows, completions in Poland reached 18% of existing stock in 2017. This is well ahead of the trend in the past two years, which has averaged c.10.5%. Nevertheless, in 2017 take-up in Poland increased 32% YoY. Even after a 138% surge in deliveries, take-up exceeded completions by 38% in 2017, such that vacancy fell further to 4.7%. Other than Belgium the same was true of all markets in 2017. In aggregate take-up exceeded completions by 64%. Only in the Netherlands did the vacancy rate increase slightly in 2017.