After spending many years as an unloved also-ran, the FTSE 100 is finally getting its moment in the spotlight.

While it hasn’t produced any growth in 2022, it has managed to fall by less than just about every other major index on the planet.

So far this year, the FTSE 250 and S&P 500 have both fallen more than 20% (the generally accepted definition of a bear market) and the US tech-focused NASDAQ index has fallen more than 30%.

In contrast, the FTSE 100 has fallen just 6% year-to-date.

Despite this recent run of relative success, investors are still wary of the FTSE 100, because its performance since 1999 has been terrible.

Ever the contrarian, in the rest of this post I will argue that the FTSE 100’s current price is somewhat attractive and that a bear market would only make it more attractive. I’ll also come up with a fair value estimate for the index and a conservative scenario for expected returns over the next decade.

But first, let’s get the bad news out of the way.

The FTSE 100 has gone nowhere for 22 years

As I write, the FTSE 100’s price is 7,200 and that’s virtually unchanged from the 6,900 it first reached in 1999, more than 22 years ago.

Even worse, if the FTSE 100 followed much of the rest of the world into a bear market the index would fall (at the very least) to 6,100, which would be comfortably below where it was 22 years ago.

This terrible track record is one of the main reasons why almost nobody brags about investing in the FTSE 100. It’s also one of the main reasons why so many young UK investors choose to invest in the S&P 500 or (if they can afford it) UK property.

But as we all know, past performance is no guarantee of future performance, and that applies to bad performance as well as good.

So instead of extrapolating the FTSE 100’s poor track record into the future, we need to ask ourselves, what is going on here? Why has the FTSE 100 performed so badly?

If we do that, then the FTSE 100’s future begins to look a little less bleak.

The FTSE 100 went nowhere for 22 years because valuations in 1999 were crazy

Everyone knows the story of the dot-com bubble, where the valuations of internet-related stocks went to the moon and then crashed back down to earth.

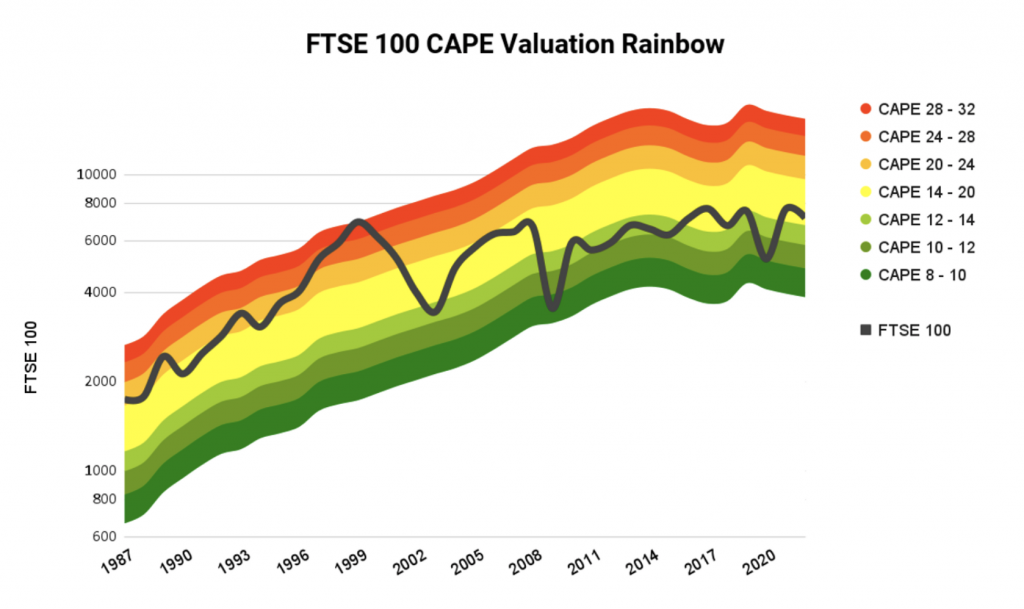

We can accurately capture that story by looking at the FTSE 100’s CAPE ratio, or cyclically adjusted PE. CAPE is an improved version of the standard PE ratio because it compares the FTSE 100’s price to its inflation-adjusted 10-year average earnings, and that smooths out the short-term earnings volatility that can make the standard PE ratio somewhat unreliable.

Fundamentally, CAPE works just like the standard PE ratio: when CAPE is above average the price is high and when CAPE is below average, the price is low.

The following chart plots the FTSE 100’s price (in black) superimposed over a CAPE rainbow, where red shows where the FTSE 100 would have been at high valuations, yellow shows where it would have been at average or ‘fair’ values and green shows where the index would have been at low valuations.