Investors as a group are as pessimistic and afraid as they’ve been for a long time.

Many investors are willing to sell at almost any price to escape these negative feelings, and that has pushed the FTSE 250 down more than 20% (the standard definition of a bear market) from its late 2021 peak.

Despite all this fear, bear markets are actually good for long-term investors because bear markets cause an index’s price to fall much further than its intrinsic or fair value.

That’s because fair value is based on an index’s ability to pay dividends over many decades, and a one or two-year recession will have little impact on dividends paid five, ten or twenty years from now.

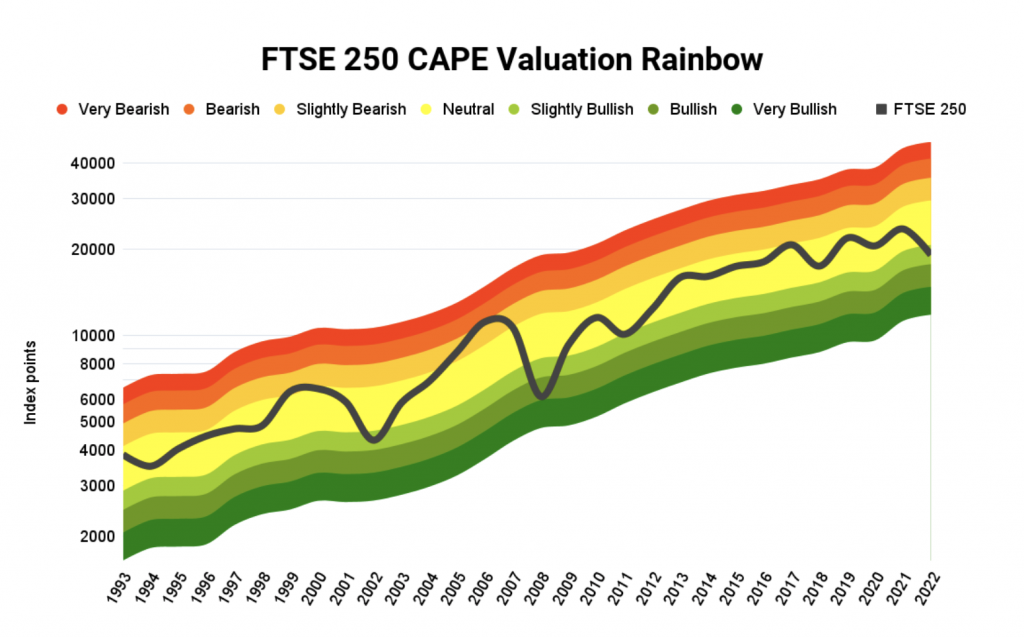

So in the rest of this post, I’m going to compare the FTSE 250’s now much lower price to an estimate of its fair value, to see what that implies for the index’s expected returns over the next decade.

What is fair value for the FTSE 250?

The first thing we need to do is work out what the FTSE 250’s fair value actually is, because fair value, also known as intrinsic or investment value, is the single most important number in investing.

Here’s a quote explaining why, from John Burr Williams in his seminal 1938 book, The Theory of Investment Value:

“Intrinsic Value, defined as the present worth of future dividends, or of future coupons and principle, is of practical importance to every investor because it is the critical value above which he cannot go in buying or holding, without added risk.

If a man buys a security below its investment value he need never lose, even if its price should fall at once, because he can still hold for income and get a return above normal on his cost price; but if he buys it above its investment value his only hope of avoiding a loss is to sell it to someone else who in turn must take the loss in the form of insufficient income.

Therefore, all those who do not feel able to foresee the swings of the market and do not wish to speculate on mere changes in price must have recourse to estimates of investment value to guide them in their buying and selling.”

– John Burr Williams, The Theory of Investment Value, 1938

The standard approach to estimating fair value is to model an investment’s future dividends and then calculate their present value based on your target rate of return (in other words, to build a discounted dividend model).

That is exactly how I value companies, but for indices I use the CAPE ratio (cyclically adjusted PE) instead, partly because CAPE is commonly used to value indices and partly because I’ve been using CAPE for well over a decade and I know it’s a good valuation tool.

For the uninitiated, CAPE is the same as the standard PE ratio, but instead of comparing price to last year’s earnings, it compares price to the ten-year average of inflation adjusted earnings. By averaging earnings over a ten-year period, we get a very stable figure to compare price against, and this is similar in nature to the stable figure we would get from a dividend model based on long-term dividends.

Fair value is simply the price at which the FTSE 250’s CAPE ratio equals its long-term average. Also, the higher CAPE rises above average the more expensive the index becomes, and the further CAPE falls below average the cheaper the index becomes.

So, what is the FTSE 250’s long-term average CAPE ratio?

The chart below shows the evolution of the FTSE 250’s CAPE ratio over the last 30 years. While 30 years isn’t very long, the period from 1993 does cover booms and busts, so it should be reasonably representative of the longer-term.