Like most stock market indices around the world, the S&P 500 did not have a particularly good 2022.

Shortly after reaching a new all-time high in 2021, the index went from 4,766 at the start of 2022 to 3,840 by the end, recording a capital loss for the year of 19.4%.

From its all-time high of 4,973, the S&P 500 has now fallen 23% (as at January 1st), so the US large-cap index is still in a bear market.

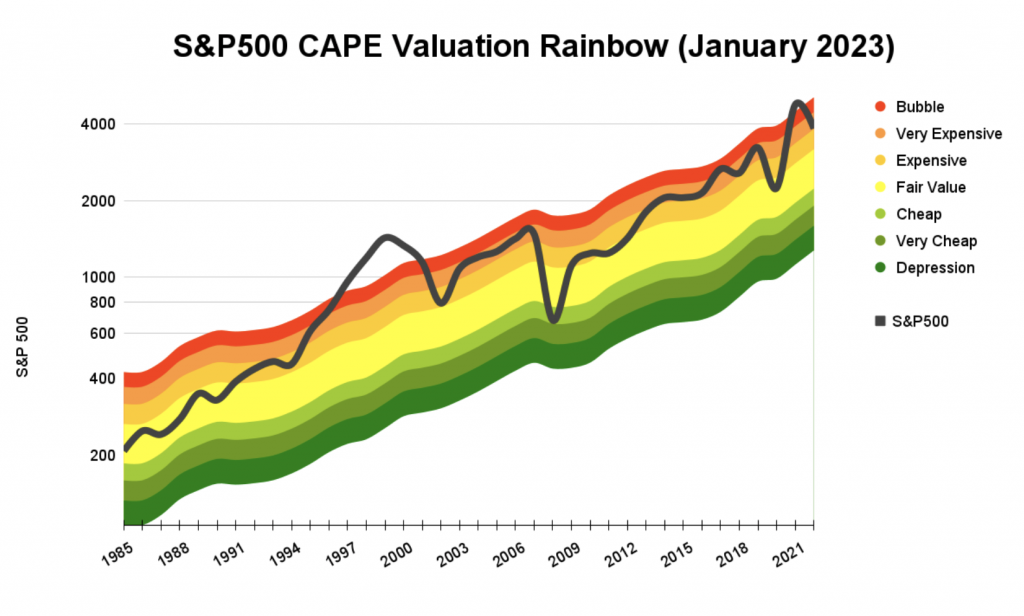

Unfortunately, the S&P 500’s CAPE ratio reached bubble levels in late 2021, so despite these double-digit declines, the index still has a long way to go before valuations reach historically normal levels.

All good things (and bull markets) must come to an end

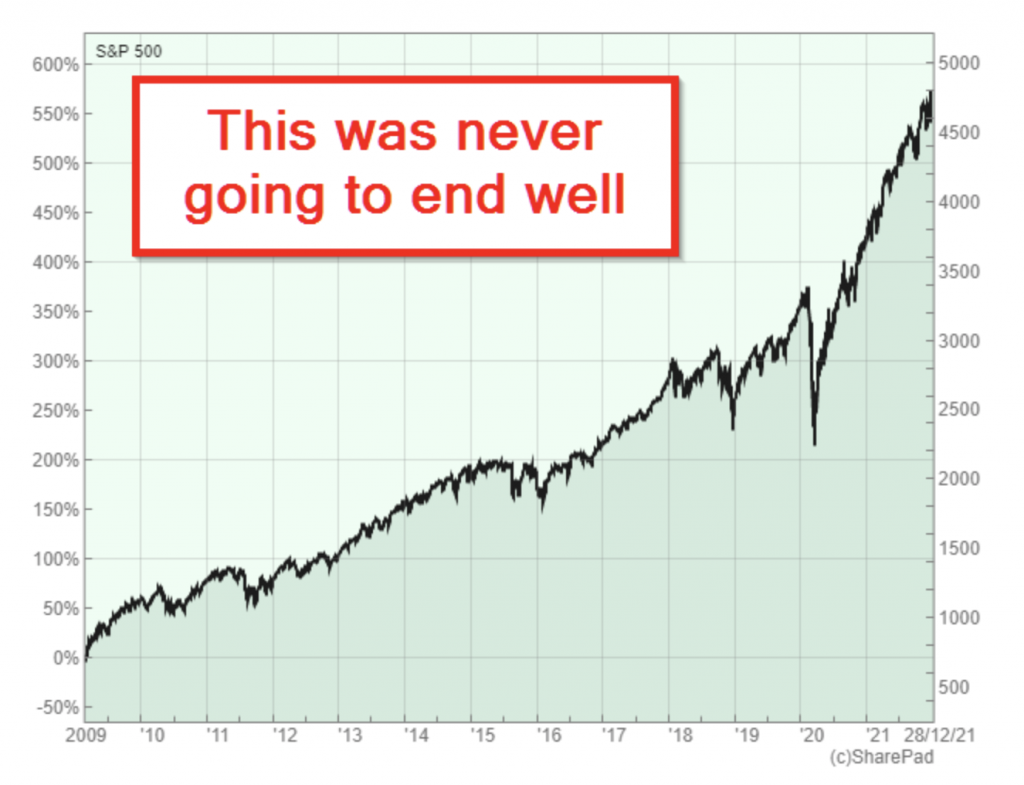

You don’t have to be Warren Buffett to know that the S&P 500 has just been through one of its longest bull markets, which started way back in 2009 (if you ignore the short-lived covid-crash of 2020).

From the beginning of the bull market to end, the S&P 500 went up almost 600%, from less than 700 in 2009 to almost 5,000 in late 2021. This has, of course, made many investors very happy.

There are downsides to long bull markets though. One of the main downsides is that long bull markets gradually suck in more and more cash from less and less experienced investors. The least experienced investors usually get in right at the top, just before the whole thing comes crashing down.

And I’m not just using the word ‘crash’ for dramatic effect, because the simple truth is that long bull markets have almost always ended in severe bear markets.

For example, after a largely unbroken 20-year bull market from 1948 to 1968, the S&P 500 lost more than 60% in real terms over the next 14 years.

The index then enjoyed another almost unbroken 20-year bull market from 1982 to 2000, and that was also followed by a near-60% real-terms loss over the next nine years.

So, the lesson from history is clear: Long bull markets are great while they last, but historically their legacy has been a decade or more of potentially devastating losses.

In 2021, the S&P 500 almost reached dot-com levels of insanity

Long bull markets are usually followed by vicious bear markets because the prolonged period of steady gains leads to a build-up of optimism that drives prices and valuations to levels that are completely unjustified by fundamentals like revenues, earnings and dividends.

Reality can be an unpleasant place, so eventually, something undermines that optimism and prices start to fall, just a little. Falling prices further undermine optimism and that makes prices fall a little more, and before you know it, optimism turns into panic and everybody starts running for the exit.

For a detailed look at how optimism and pessimism are key drivers of cycles in the economy and the stock market, you should read Howard Marks’ book, Mastering the Market Cycle. Alternatively, the image below captures the emotional rollercoaster that drives bull and bear markets.