(and what can you do about it).

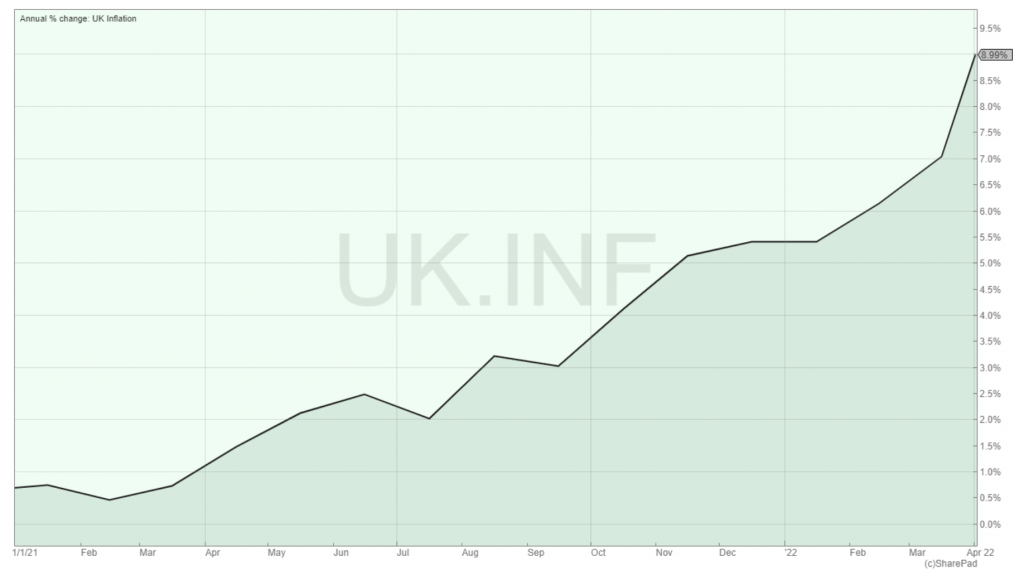

Inflation is expected to exceed 10% later this year and could stay above 5% through 2023, 2024 and perhaps even longer.

And that may be optimistic, seeing as the UK’s energy price cap is expected to be 119% higher (£2800 vs £1277) this winter compared to winter last year.

From an investment point of view, the problem is that most investors haven’t experienced that level of inflation during their investing lifetime. In fact, if you’re under 40, you weren’t even born the last time the UK had 10% inflation.

With that lack of experience in mind, I thought it would be a good idea to spend some time thinking about how inflation might impact a portfolio of dividend-paying companies.

To be honest, inflation and macroeconomics is a bit of a rabbit hole, so in this post I’ll just cover what I think are the most important effects.

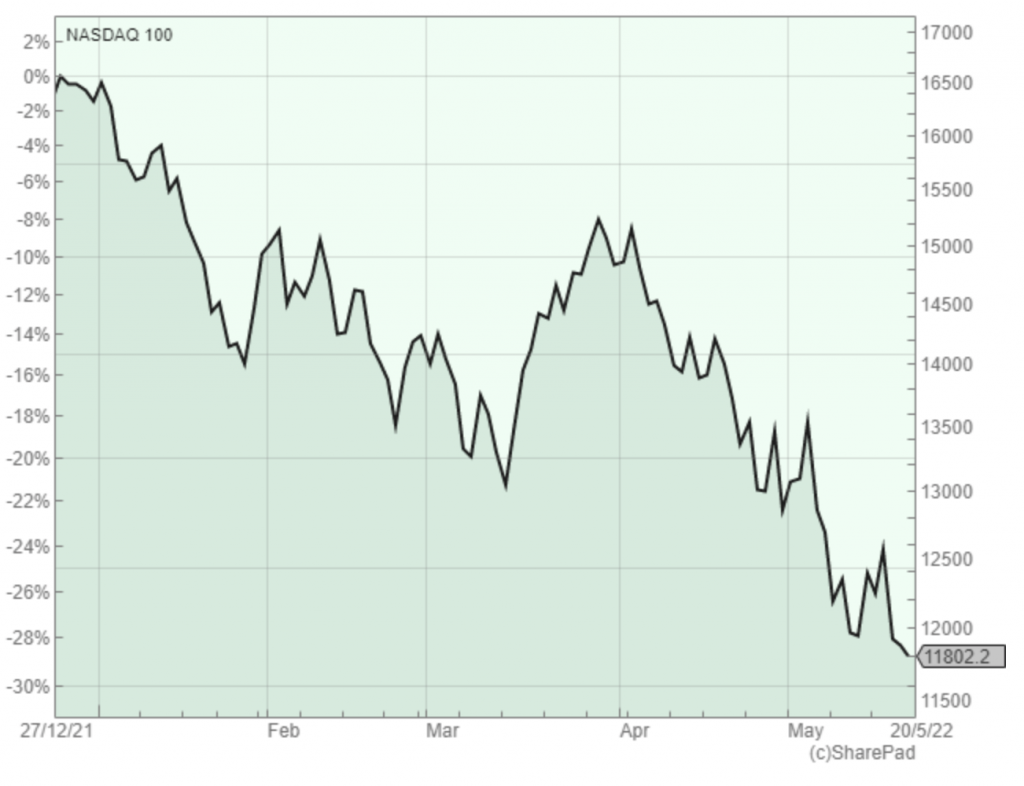

Inflation makes share prices go down

Inflation’s first effect shows up almost before inflation has begun to rise.

The effect is that share prices, especially those of highly-rated growth stocks, begin to go down as soon as investors start to expect higher inflation.

It’s important to be aware of this so that you’re not surprised by it.

Share prices go down partly because investors expect high inflation to eventually cause a recession, or something close to it, but mostly they go down because investors expect interest rates to go up.

And when interest rates go up, the yield on “risk free” bonds (typically government bonds) also goes up, and that has a direct impact on the price investors are willing to pay for shares.

Shares are riskier than bonds, so investors need a risk premium (a higher return) to compensate them for taking more risk. If bond yields go up and if the risk premium stays the same, the yield on stocks will also go up.

And how does the yield on a share go up?

Simple: Its price goes down.

So share prices decline because they’re hit by a double whammy from (a) lower expected earnings thanks to an expected downturn and (b) higher desired yields thanks to increasing bond yields.

Is there a way to avoid this?

Possibly.

You could jump into commodity stocks. They generally do well when inflation is rising, but if you were going to jump into Shell then you probably should have done it last summer as its share price has already gone up 80% since then.

And that’s the problem with tweaking your portfolio to take account of inflation and other macroeconomic factors: You need to (a) be right and (b) act very quickly, otherwise like-minded but fleeter-foot investors will push up the price of inflation-winners and reap the capital gains before you can say “market timing is really hard”.

But don’t be disheartened.

Even billionaire value investor Warren Buffett freely admits that adjusting a portfolio to take account of the changing inflationary and macroeconomic environment is near impossible for mere mortals:

“We will continue to ignore political and economic forecasts which are an expensive distraction for many investors and businessmen.” – Warren Buffett

Rather than tweaking his portfolio to suit the environment, Buffett’s approach is to always be invested in a portfolio of companies that are very likely to survive and thrive over the long-term, regardless of what inflation and the economy throw at them.

However, even the highest quality companies can see dramatic share price declines when inflation rises, so Buffett’s second line of defence is to own quality companies when their price is already materially below fair value.

Owning stocks where the share price is below fair value can help reduce downside risk because:

- The price is already low and there are limits to how far below fair value a stock’s price will go

- The lower price should produce a higher dividend yield and that higher income could partially offset any price decline

- If the price falls further below fair value, then the lower price might be an excellent opportunity to buy more shares

The last point is perhaps the most important. If you own quality companies at attractive valuations and you’re investing for the long-term, then falling share prices should, in most cases, be more of an opportunity than a risk:

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons.”– Warren Buffett

Inflation squeezes profit margins

Inflation’s second major effect is that companies begin to see their costs rising faster. The price of energy goes up, the price of raw materials, components and goods goes up, and eventually the cost of labour goes up.

If a company’s expenses are going up because of inflation then its profit margins and profits are going to get squeezed. If costs go up fast enough, profits can even be squeezed out of existence.

To avoid that unhappy scenario, companies have two main options:

- Cut costs, or

- Pass inflation onto customers by raising prices

Cutting costs is a good place to start because good companies are always looking to cut costs. They could substitute expensive raw materials for cheaper substitutes, use less raw materials (as companies like Unilever and AG Barr have done by making bottles and cans thinner) or you can replace humans with machines.

This takes time and it will only get you so far. The only sustainable way to deal with inflation is to pass it onto the customer, by raising the price of goods and services.

But raising prices is easier said than done. Customers are probably already being squeezed by rising inflation, so the last thing they’ll want to see is yet more price rises.

To have any chance of passing inflation onto customers, a company needs to have at least some degree of pricing power.

Pricing power means a company can consistently increase prices without alienating or losing too many customers.

So how do we find companies with pricing power?

My suggestion would be to look at a company’s return on capital employed, which is the amount of profit a company generates from its fixed capital and working capital.

In the UK, the average post-tax return on capital is around 10%. If a company can consistently produce returns on capital that are above 10% then it almost certainly has pricing power.

If it didn’t, competitors who were willing to earn slightly lower returns (but still above average) would undercut the company on price and steal its profits. The fact that a company has consistently earned above average returns on capital over many years is a good sign that either (a) it can charge higher prices without losing customers, (b) it has lower cost operations or (c) both.

Because a consistently high return on capital is good evidence of pricing power, I have a related rule of thumb:

- Rule of thumb: Only invest in companies where return on capital is consistently above 10%

And according to Warren Buffet, it’s a good idea to own these companies at all times and not just when we’re seeing high inflation.

For example, my UK Dividend Stocks Portfolio currently holds 25 companies, shown below in order of their ten-year average net return on capital employed (ROCE):