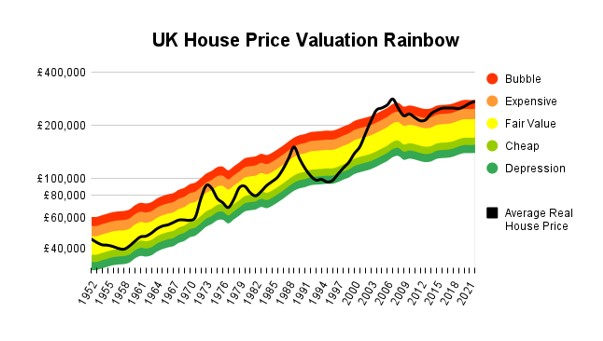

I think you would be hard pressed to find anyone who thought house prices were cheap.

For example, a 30-year-old first-time buyer will need a 5% deposit at the very least.

The average UK house price (according to Nationwide) reached £273,000 in 2022, so even a measly 5% deposit will set them back almost £14,000, and few 30-year-olds have that much cash sitting around.

No wonder home ownership among 25-34-year-olds has almost halved over the last 30 years, and that the proportion of joint first-time buyers has increased to 63%, outnumbering individual first-time buyers who used to make up the majority.

This is clear evidence that house prices are simply unaffordable for most people under 30 unless they pair up with someone and buy as a couple.

The other option is to borrow from The Bank of Mum and Dad (BOMAD), if you’re lucky enough to have one. BOMAD lends about £5 billion per year, funding about £80 billion of property purchases that otherwise wouldn’t happen.

The growth of BOMAD lending is a key reason why the average deposit (according to the Halifax First-Time Buyer Review) is now an astonishing £62,000. That’s more than the average house cost in 1997.

And even if our intrepid first-time buyer does manage to scrape together a 5% deposit, they’ll need a 95% mortgage. If they want to buy an average house with its average price of £273,000, they’ll need a mortgage of about £260,000.

If our first-time buyer earns the average UK wage of £32,000, they’ll need to borrow eight-times their income. That’s a problem because most banks only lend up to five-times income. If you need more than that you’ll need a salary far above average or a much bigger deposit (most likely via BOMAD).