Welcome to a slightly delayed 2022 half-year review of the UK Dividend Stocks Portfolio.

My original plan was to review the portfolio in July, but work (mostly a slew of interim results that needed analysing) got in the way, so here we are with a mid-year review in mid-August.

As usual, I’ll review the portfolio’s performance as well as any changes I’ve made to the portfolio or my investment process, and I’ll highlight any key points you may find useful.

Markets fell in early 2022, but over the long-term they tend to go up

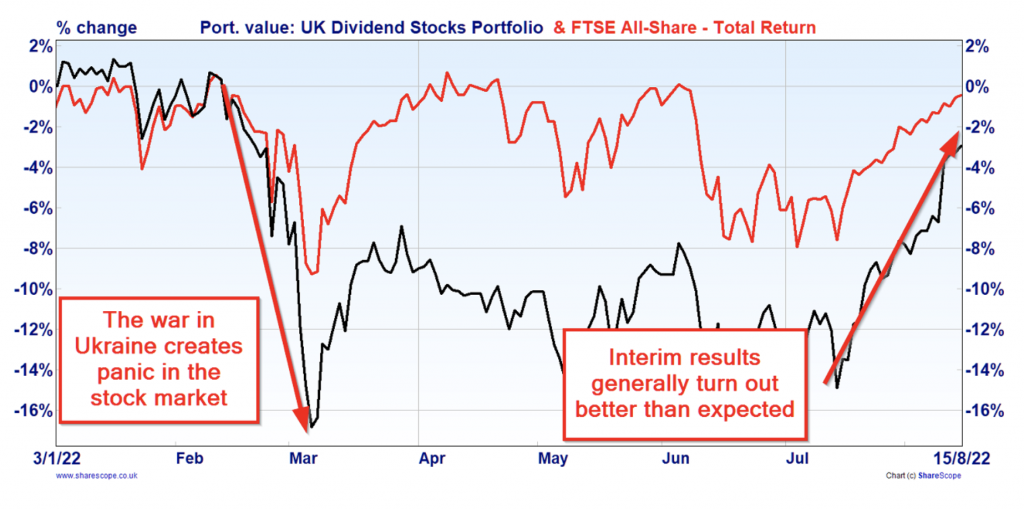

The beginning of 2022 was of course marred by Russia’s invasion of Ukraine. The long-term consequences of that invasion were (and still are) highly uncertain, so many investors sold up and headed for safer ground. As a result, share prices and stock markets fell off a cliff.

At one point the portfolio was down 16%, which isn’t quite bear market territory, but it’s enough to make me feel slightly uncomfortable. And that’s an interesting point, because I know, intellectually, that short-term performance is irrelevant, but this sort of decline still has a (small) emotional impact on me.

So, here are a couple of mental tricks I use to help me ignore short-term price volatility:

- Rule of thumb: measure progress using dividends rather than share prices.

- Rule of thumb: if you do look at capital gains or losses, ignore one-year returns and focus on returns over five years and 10 years.

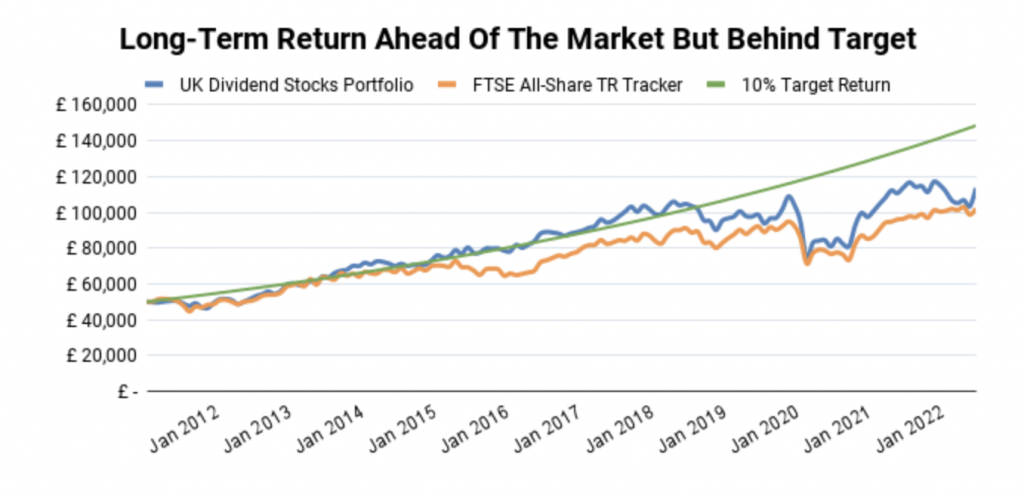

I’ll get to the portfolio’s dividends in a minute, but first, let’s focus on longer-term capital gains so we can put these short-term ups and downs in context. Also, the portfolio only invests in FTSE All-Share stocks, so that’s the benchmark.

If we focus on the very short term by looking at returns from the start of 2022 to early March, when markets hit rock bottom, the portfolio was down 16% and the FTSE All-Share (total return) was down about 9%. This is the sort of thing that makes investors jump ship long before they’ve reached their investment goals.

if we zoom out and focus on five-year total returns then things look a little less bleak, with the portfolio producing total returns of 19% versus 23% for the All-Share, or 3.6% and 4.2% per year on an annualised basis. That isn’t great, but it isn’t surprising either, given that we’ve just been through a global pandemic and we’re on the brink of a UK recession. More importantly, returns over five years are positive.

If we zoom out even further, total returns over 10 years are 121% for the portfolio and 102% for the All-Share, which is 8.2% and 7.3% annualised, respectively.

I don’t know about you, but this helps me put short-term declines into context. Yes, markets fell quite a bit in early 2022, but over 10 years or more they tend to go up, and they tend to go up quite a lot.

Here’s what those longer-term returns look like on a chart.

From this 20,000 foot perspective, the recent market declines look like nothing more than just another temporary (and inevitable) setback in a long-term uptrend.

In fact, markets have recovered in recent weeks and, as I write, the portfolio is down just 3% for the year, while the All-Share is up 1%. Investors who jumped into cash in March may well be kicking themselves.

As you no doubt spotted, the chart above includes a 10% Target Return line. This shows you where the portfolio would be if it was performing in line with my target return of 10% per year. Of course, no equity portfolio is going to metronomically produce 10% returns per year, but I find it useful to plot out where I would like the portfolio to be (ideally, above that green line).

That 10% Target Return line ties in with my long-term goal for the portfolio, which I’ll explain in a moment. But first I want to cover some of the results statements that have come in over the last few weeks.

Despite the obvious headwinds, the portfolio’s interim results were surprisingly positive

Seventeen out of the portfolio’s 24 holdings have now announced their interim or annual results and just about every one of them was upbeat.

The only dividend cut came from Admiral Insurance, but that was expected because the 2021 dividend was abnormally high, thanks to lockdowns that massively reduced the number of miles driven (and therefore the number of claims).

Other than Admiral, dividends were either maintained or raised and most holdings have seen little or no sign of an economic slowdown. That stands in stark contrast to the fairly large share price declines that some of these companies have suffered, so here’s another useful mental trick: